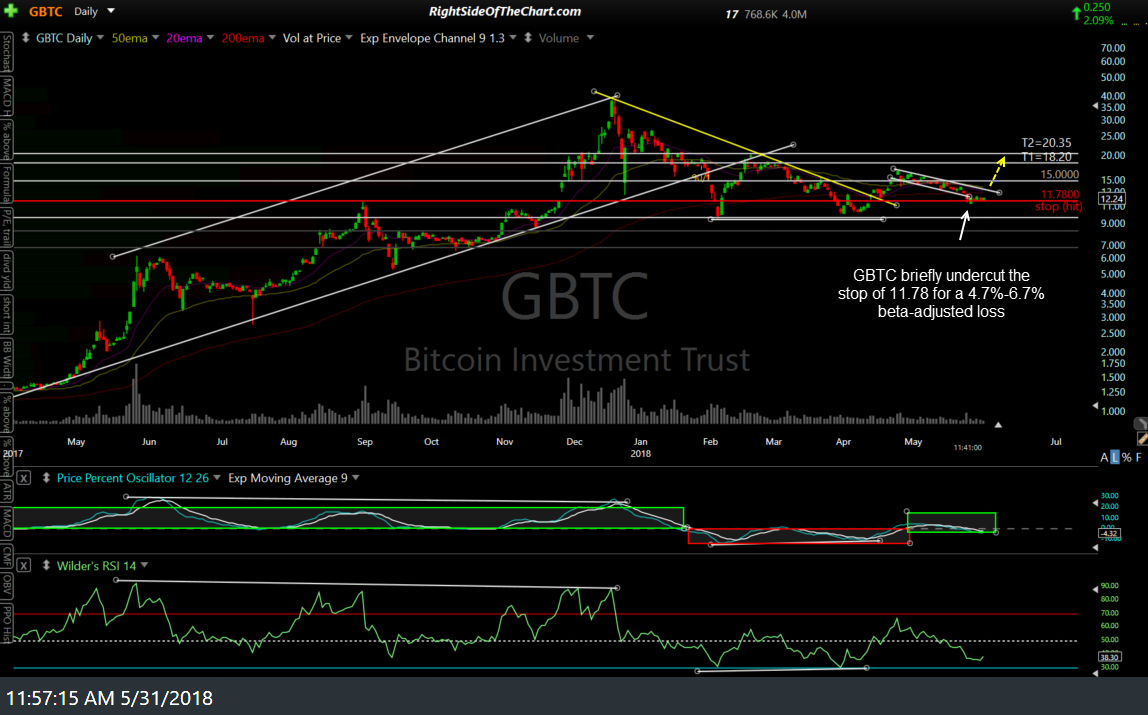

The GBTC (Bitcoin Investment Trust) swing trade briefly undercut the stop of 11.78 last week for a 4.7%-6.7% beta-adjusted loss*. As mentioned in the recent trade ideas video, the near to intermediate-term outlook for Bitcoin remains bullish and as such, GBTC is on watch for another long entry.

GXBT (Bitcoin futures) looks poised to rally up to at least the 8270 area with the next buy signal to come on a break above the 7635ish resistance level. 60-minute chart:

*Due to the aggressive & volatile nature of GBTC, the suggested beta-adjusted position size for this trade was 0.35- 0.50 (approximately 1/3rd to 1/2 of a typical position size). As such, the beta-adjusted loss was 13.5% (total loss) x 0.35 = 4.7% to 13.5% x 0.5 = 6.7%.