Member @mike6677 inquired about CURE (3x bullish healthcare ETF) within the trading room, to which I replied:

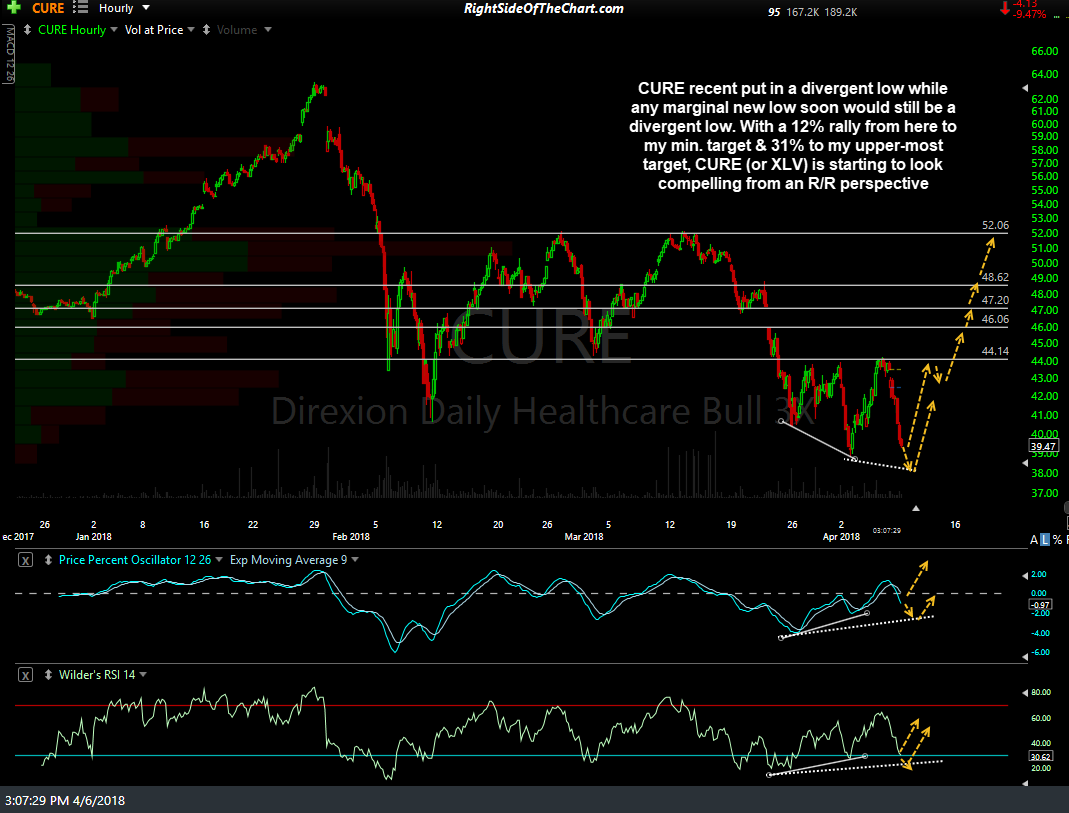

Possibly but going long CURE or XLV (the non-leverage healthcare ETF) would certainly be trying to catch a falling knife. Nothing remotely close to a buy signal on either yet although there are some divergences building on the 60-minute chart. My guess is that XLV & CURE bounce with the broad market next week but first things first & that would be to see a nice rally into the close today with the current support levels on QQQ be successfully defended.

Should my Inverse Head & Shoulders/W-bottom scenario on QQQ play out with a rally starting either into the close today or early next week, CURE (or XLV, which is the 1x non-leveraged healthcare sector ETF) looks to offer a very compelling R/R with what appears to me as minimal downside (~4% or so) compared to the upside potential of 12%- 31% from current levels. I’m passing this along as an unofficial trade idea for now as CURE & XLV are still clearly in a downtrend without any technical evidence of a reveral yet but wanted to pass the idea along for those that might want to take a partial postion before the close today, possibily adding to the position next week if the charts start to firm up.