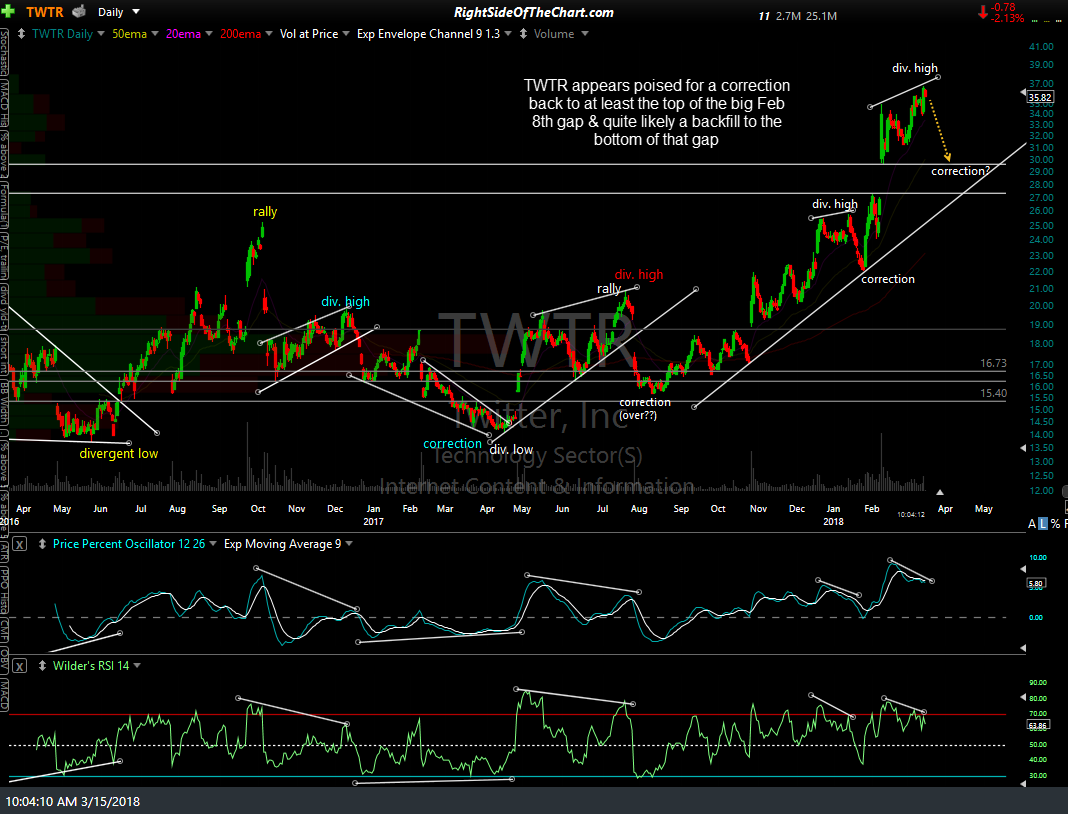

TWTR (Twitter, Inc) appears poised for a correction back to at least the top of the big Feb 8th gap & quite likely a backfill to the bottom of that gap following this most recent divergent high on both the daily & 60-minute time frames. The first daily chart below shows a clear history of divergent highs on the stock, followed by corrections, as well as divergent lows, followed by rallies.

The next chart below is the 60-minute time frame with the suggested price targets for this trade; T1 at 33.94, T2 at 31.51 & T3 at 27.55. Twitter will be added as an Active Short Trade here as the stock offers a somewhat aggressive entry on anticipation of a break below this 60-minute uptrend line with an alternative, more conventional entry or add-on to a partial position on a break below the trendline or 33.90. The maxium suggested stop for those targeting T3 (a near-backfill of the Feb 7/8th gap) will be any move above 38.50 with a suggested beta-adjusted position size of 0.90.