In the August 30th post, QQQ & FAAMG Stocks: Mixed Bag Of Technicals, I zeroed out AAPL (Apple Inc.) as the most bearish of the lot, stating:

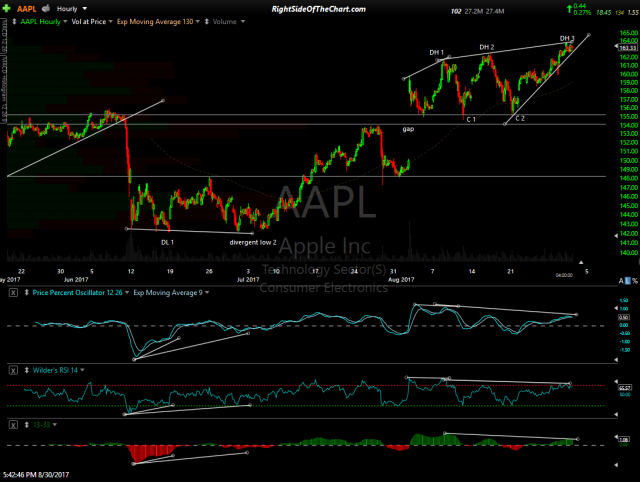

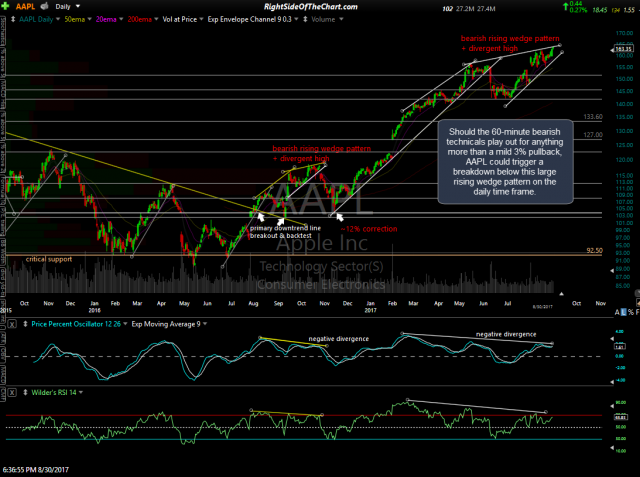

Finally the 800-lb. gorilla, AAPL. While it’s hard to make a bearish case on a stock trading at or just off all-time highs, I will say that the largest component of both the Nasdaq 100/QQQ, as well as the S&P 500/SPY, looks poised for a correction with a sell signal to come on a break below this 60-minute uptrend line/bearish rising wedge pattern. While normally I wouldn’t expect anything more than a relatively shallow & short-lived pullback from the break below such a small pattern on the 60-minute time frames, particularly with the primary uptrend still bullish, Apple is also sitting precariously close to the bottom of a much larger bearish rising wedge pattern on the more significant daily time frame. As such, a break of this smaller 60-minute wedge could be the catalyst for a drop that triggers a more powerful sell signal on the daily time frame. Something to monitor IMO as a correction in AAPL would most certainly provide headwinds to the rest of the market.

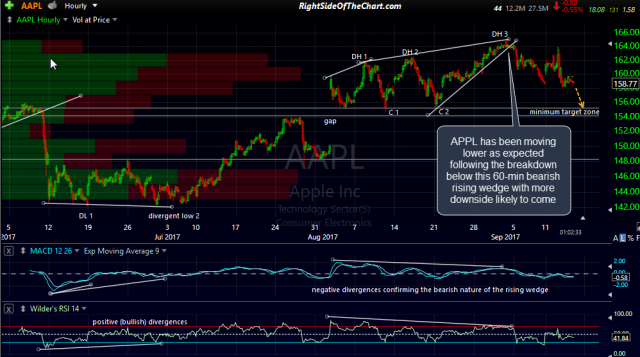

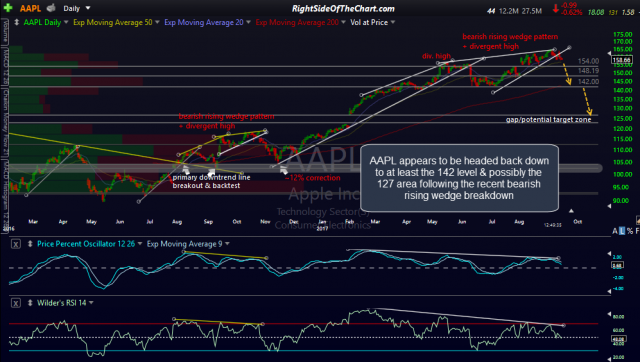

Not surprisingly, as those bearish rising wedges on the 60-minute & daily charts were ready to pop at any time, with prices approaching the apex of the wedges, the announcement of the new Samsung Galaxy S8 clone Apple iPhone X & iPhone 8’s was the catalyst needed to trigger those breakdowns.

- AAPL 60-min Aug 30th

- AAPL 60-minute Sept 14th

- AAPL daily Aug 30th

- AAPL daily Sept 14th

The 60-minute & daily charts from that post 2 weeks ago along with the updated charts are shown above. As the breakdown below the 60-minute wedge was indeed the catalyst for a break below the rising wedge on the more significant daily time frame, AAPL appears to be headed back down to at least the 142 level & possibly the 127 area.