The agricultural commodity ETN, particularly the grain ETNs that have been highlighted recently are now approaching some of the key resistance levels & price targets from those previous updates going back to May.

All three of the grain ETNs; CORN, SOYB & WEAT, as well as JJG, the UBS Grains Total Sub-Index ETN which is comprised of corn (46.83%), soybeans (32.70%) & wheat (20.46%), have posted impressive rallies in recent weeks. Although the longer-term outlook continues to firm up, in the near-term the grains are getting quite overbought with the odds for a pullback and/or consolidation increasing as each overhead target/resistance level is reached. Here’s a quick look at the previous & updated daily charts of each:

SOYB (soybeans ETF) hasn’t looked back since putting in a divergent low & going on to break out above the bullish falling wedge pattern. As prices are quite stretched at this time, a pullback to the 19.00-18.80 area would offer the next objective long entry with 18.50 as the next objective support/entry level, should prices correct soon.

- SOYB daily May 22nd

- SOYB daily June 6th

- SOYB daily July 10th

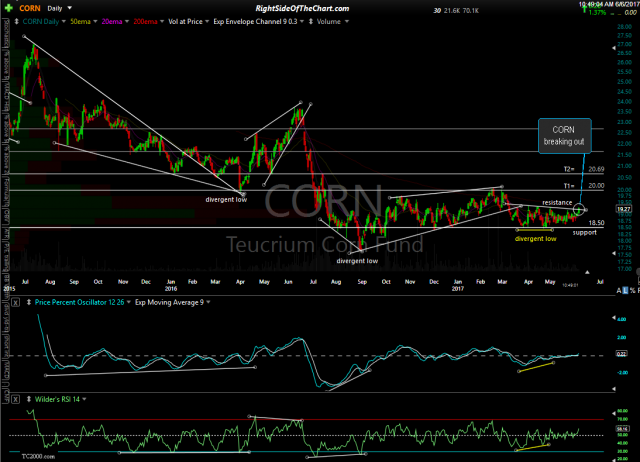

CORN (corn ETN) hit my first price target of 20.00 today, where the odds for a reaction are elevated although I still favor a move up to at least the 20.70ish are in the coming weeks to months.

- CORN daily May 22nd

- CORN daily June 6th

- CORN daily July 10th

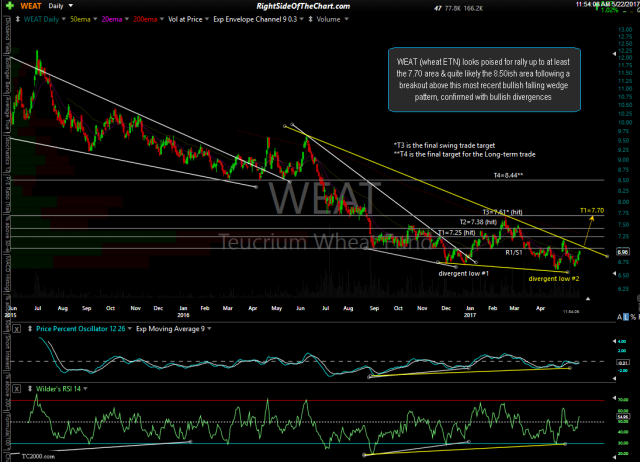

WEAT (wheat ETN) has mounted a very impressive rally following the divergent low back in late April & the subsequent breakout above the bullish falling wedge pattern. With prices already coming within pennies of my long-term target, WEAT may or may not get one more thrust up to that level soon but either way, it would be best to see a pullback or consolidation before adding to or initiating a position.

- WEAT daily May 22nd

- WEAT daily June 6th

- WEAT daily July 10th

JJG (grains ETN) has ripped following the breakout & recent backtest of the bullish falling wedge pattern & has just cleared the mid-February reaction high. As JJG is starting to become overbought, the odds for a pullback and/or consolidation increases with every tick higher although the longer-term bullish case continues to firm up.

- JJG daily June 6th

- JJG daily July 10th

If my suspicions are correct, I think we will continue to see money move out of equities as well as corporate bonds, both investment grade & high-yield, and into select commodities including precious metals over the next year or so.

Keep in mind that various commodities, such as grains, livestock, industrial metals, oil & gas, precious metals, etc.. have unrelated fundamentals & quite often, different technical postures although the price of most commodities are usually effected by the trend of the US Dollar to some extent or the other. As such & as has been the case recently, I believe it will continue to be a “stock pickers” market in commodities going forward: Identify the most promising trade setups in the commodities arena; get in when the charts indicate a rally, get out once your profit target(s) are hit & the R/R is no longer favorable & move on to the next one or wait patiently for the next objective entry.