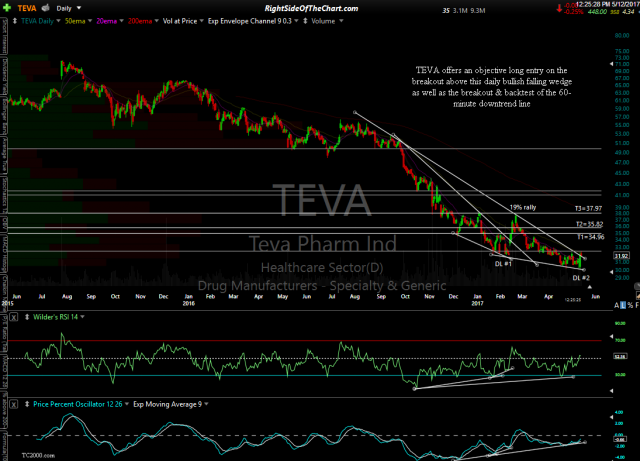

TEVA (Teva Pharmaceuticals) was added as an Active Long Swing Trade on a breakout above the bullish falling wedge pattern back on May 12th. That breakout proved to be a false breakout /whipsaw signal before one last thrust down with the bullish divergences still very much intact. From there, TEVA went on to make a solid & sustained breakout above the bullish falling wedge & closed around the 32.50ish resistance level on Friday. Previous & updated daily charts below:

- TEVA daily May 12th

- TEVA daily June 24th

As the stock is quite overbought on the short-term time frames coupled with the fact that it closed at resistance on Friday, my preferred scenario is for a pullback starting next week, possibly back down to around the 30.63ish support level, before the next thrust higher which should take the stock up towards the first price target, next resistance level around 35.00. TEVA will be reassigned to the Completed Trades category as the trade was stopped out for a 6.4% loss before reaching any of the price targets although the stock is on watch for another possible long entry.