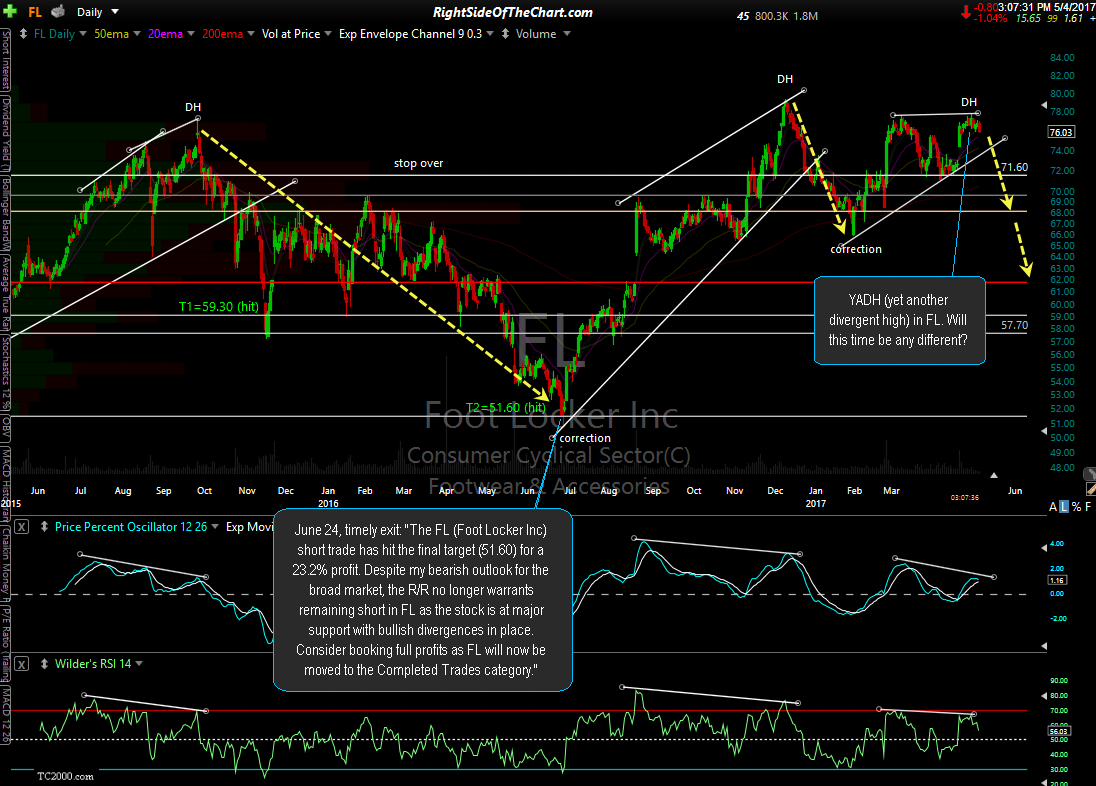

Member @ruben shared a handful of short candidates in the trading earlier today, several of which I agree look like attractive shorting opps, either at this time or pending a sell signal. I’ll follow up with some of the other charts either on the front page or within the trading room but wanted to share one of those potential (but not yet official) short candidates, FL (Foot Locker Inc). It appears that we have YADH (Yet Another Divergent High) in FL, with the daily chart below showing the corrections that followed the two previous divergent highs in FL over the last two years.

In fact, Foot Locker was added as an official short trade following that first divergent high back in 2015, with an extremely timely exit on that trade for a 23% profit mere basis points & less than one full trading session from the major bottom put in back on June 27th, 2016, the day after the final target was hit with a clear warning that it was no longer prudent to remain short. Foot Locker then rallied 56% off the June 27 lows to form, yet again, another divergent high followed by (no surprise) another correction of 17% following the Dec 2016 divergent high.

Once again the stock has come full circle, rallying about 18% following that late 2016/early 2017 correction & recently printing a divergent high on April 28th. However, that divergence is still what I refer to as potential divergence, with confirmation pending a bearish crossover on the PPO. As such, this stock is on watch as a potential official swing short trade although I’m being extra selective on adding new official short trades at this time due to the unusually large imbalance of official shorts vs. longs on the site at this time. With that being said, FL appears to offer an objective, albeit somewhat aggressive/anticipatory short entry here with a stop place slightly above last Friday’s high of 77.86.