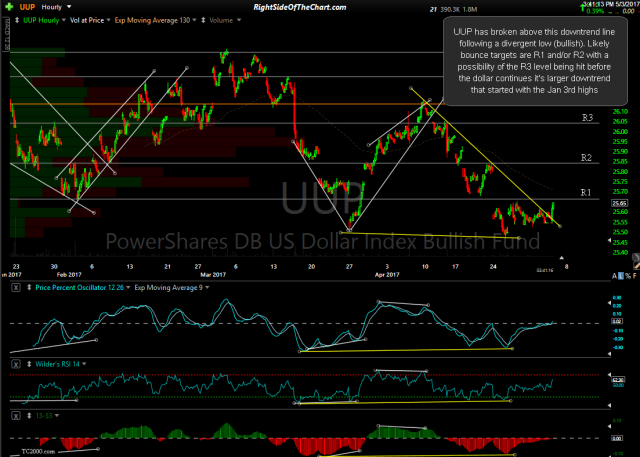

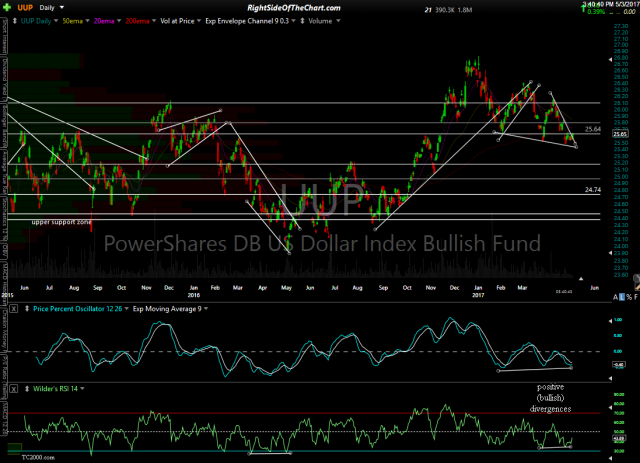

UUP (US Dollar Index ETN) has broken above this downtrend line following a divergent low (bullish). Likely bounce targets are R1 and/or R2 with a possibility of the R3 level being hit before the dollar continues it’s larger downtrend that started with the Jan 3rd highs. 60-minute & daily charts:

- UUP 60-minute May 3rd

- UUP daily May 3rd

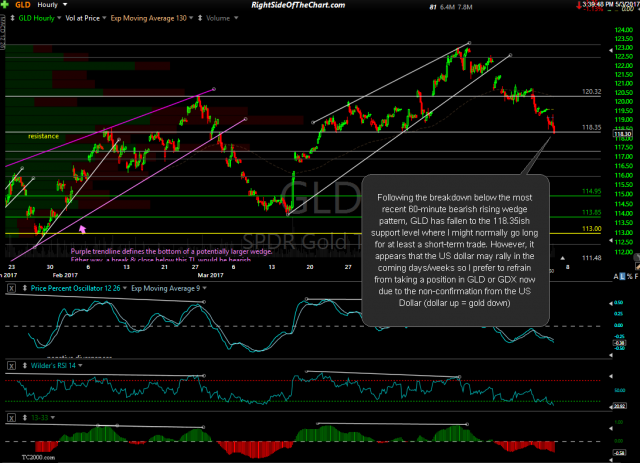

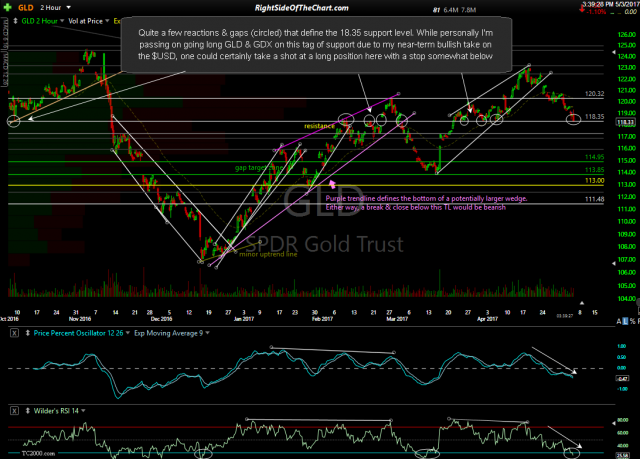

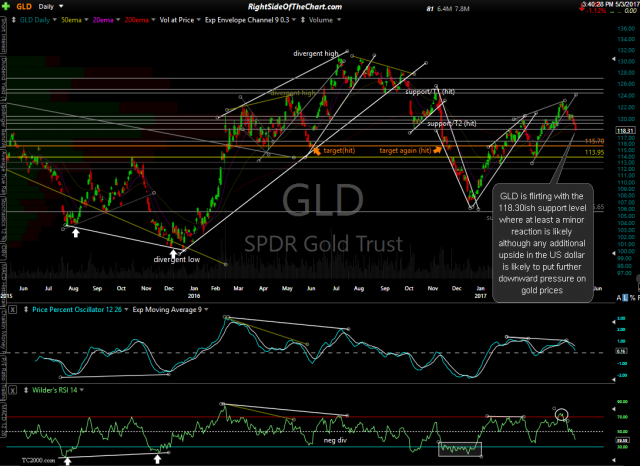

Following the breakdown below the most recent 60-minute bearish rising wedge pattern, GLD has fallen to the 118.35ish support level where I might normally go long for at least a short-term trade. However, it appears that the US dollar may rally in the coming days/weeks so I prefer to refrain from taking a position in GLD or GDX now due to the non-confirmation from the US Dollar (dollar up = gold down). 60 minute, 120 minute & daily charts of GLD. No need to post a chart of GDX at this time as the miners will ultimately follow the metal.

- GLD 60-minute May 3rd

- GLD 120-minute May 2nd

- GLD daily May 2nd