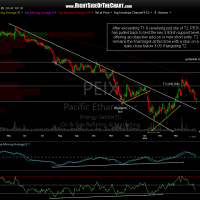

After exceeding T1 & reversing just shy of T2, PEIX has pulled back to test the key 3.80ish support level, offering an objective add-on or new short entry. T2 remains the final target at this time with a stop on a daily close below 3.00 if targeting T2.

- PEIX daily April 6th

- PEIX 60-minute April 6th

- PEIX 30-minute April 6th

Here are some additional comments that I made in reply to an inquiry on PEIX to member @gaucho in the trading room earlier today:

Yes, I believe PEIX currently does or will very soon offer a new entry or add-on at or (my preference) somewhat above that key 3.80 support level, possible at or near current levels. After reaching & exceeding the first target, PEIX has come full circle & is essentially back to the official entry price and still well above where it was trading when first highlighted. Bullish divergences setting up on the 30-minute chart as well to help confirm an entry soon.

PEIX closed at 3.92 yesterday & could continue down another 4% or so to the 3.76 area or reverse at anytime. I’ll post an update with charts on the front page today but if this helps, one strategy with this volatile, aggressive trade would be to start scaling in now, adding to the position in something like 1/4 increments (lots) over the next week or two, adding down to but not below the 3.80 level, with stops calculated bases on your average cost & your preferred price target(s) using an R/R of 3:1 or better. Should the stock reverse & start moving higher with some decent technical evidence to confirm the reversal before you have purchased your planned allotment, then you could either continue scaling in on strength or add the final amount at once, if the charts strongly indicate a near-term trend reversal from bearish to bullish.

The other option would be to wait for the stock to get closer to the 3.80 level and take a full position (BETA-ADJUSTED FOR THE HIGH RISK & RETURN POTENTIAL!) with stops calculated on your preferred price target. Should the stock shows decent evidence of a bullish reversal before then, you could also take a position at that time. G-luck & thanks for pointing out the fact that the comments were closed out.