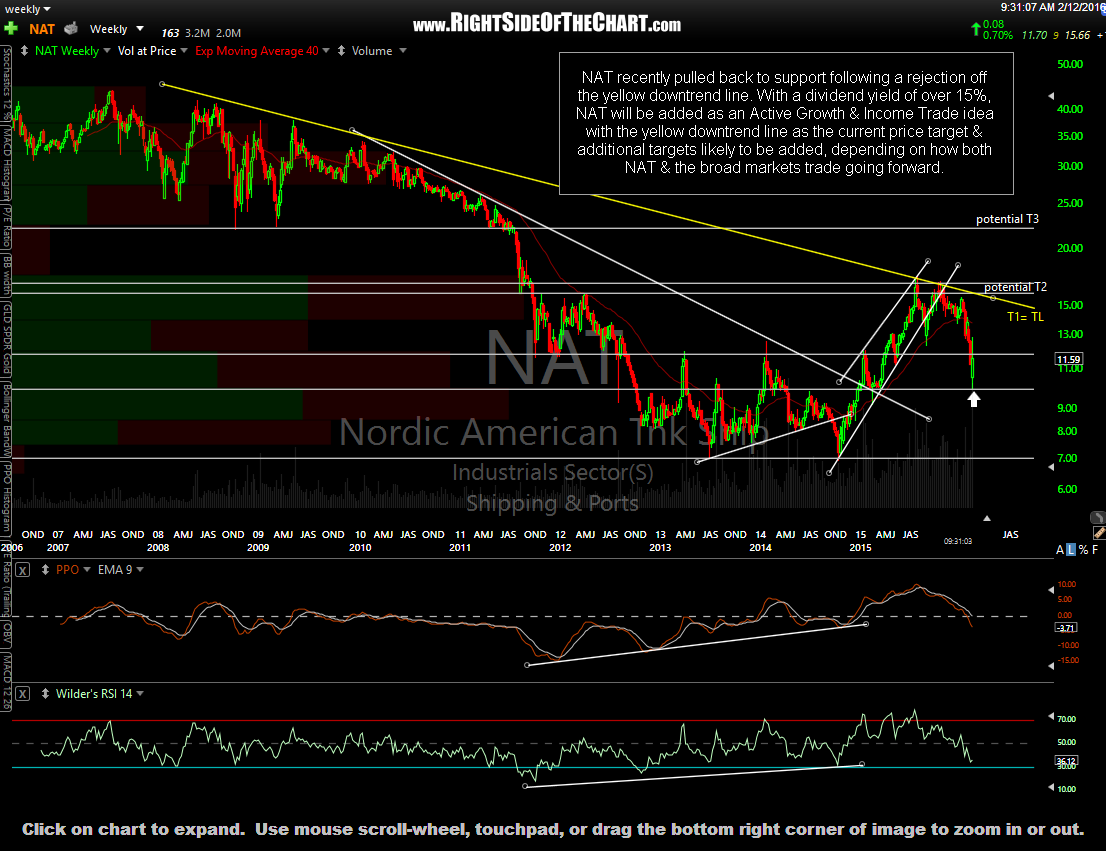

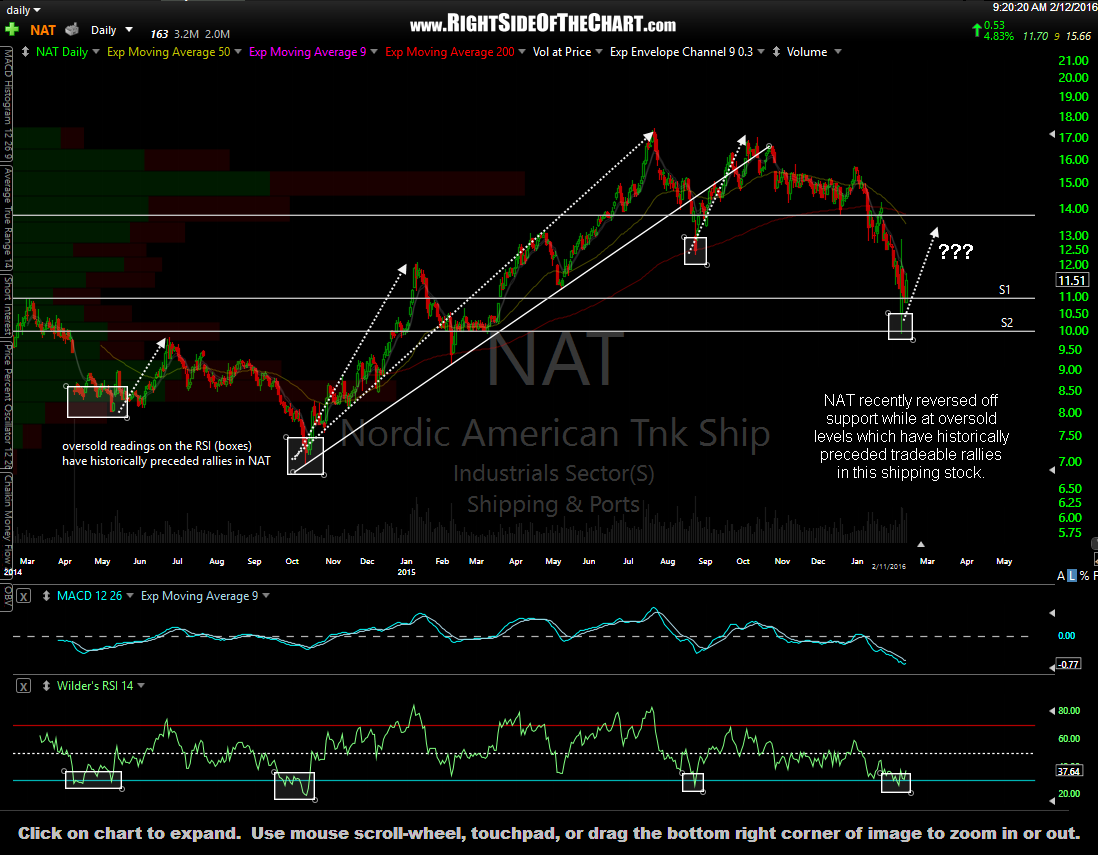

NAT (Nordic American Tankers Ltd) recently pulled back to support following a rejection off the yellow downtrend line. With a dividend yield of over 15%, NAT will be added as an Active Growth & Income Trade idea with the yellow downtrend line as the current price target & additional targets likely to be added, depending on how both NAT & the broad markets trade going forward. Suggest stop of a daily close below 9.90. Weekly chart:

Please keep in mind that stocks with above average dividend yields, which at over 15%, certainly puts NAT in that category, often run the risk of a dividend cut or elimination. NAT appears to be a case of “the baby thrown out with the bathwater” as the shipping stocks have been in a vicious bear market in recent years. I believe a solid fundamental case for NAT can be made in this recent letter from Herbjørn Hansson, Chairman & CEO of Nordic American Tankers Limited (click to view letter).