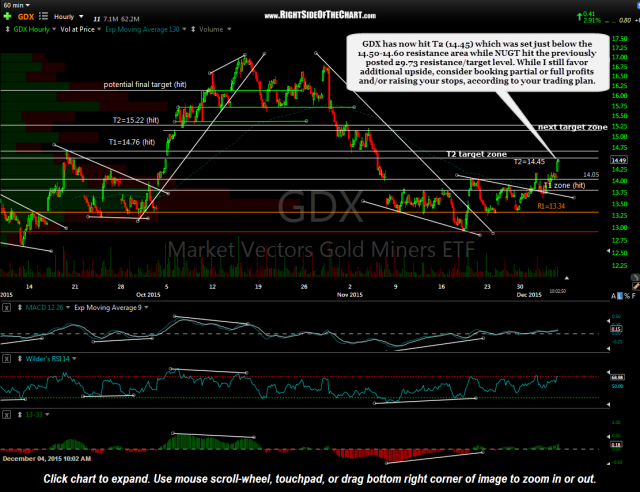

GDX has now hit T2 (14.45) which was set just below the 14.50-14.60 resistance area while NUGT hit the previously posted 29.73 resistance/target level. While I still favor additional upside, consider booking partial or full profits and/or raising your stops, according to your trading plan. As the charts of GDX & GLD remain constructive, I’ve added an additional target zone for GDX which comes in around 15.15-15.30.

- GDX 60 min Dec 4th

- NUGT 60 minute Dec 4th

As I type, NUGT is current trading at 30.65 which gives the trade a gain of more than 33% from the entry posted here on Nov 18th. However, had one booked partial or full profits for a 20% gain, as suggested in this post when the top of the T1 zone was hit on Nov 19th, then buying back into the position on the expected pullback as posted here on Nov 20th, the cumulative gains for this trade would be much higher than 32%, a good example of how active trading can beat a buy & hold strategy, even when trading a security on the long-side while in a confirmed bear market.

Once again, the GDX/NUGT long trade has the potential to morph into a much longer-term swing or trend trade, should the charts of GLD, SLV, GDX and EUR/USD continue to firm up. As such, longer-term traders might opt to just trail up stops while active traders might continue to micro-manage their entries & exits around the key target levels.