The AMD (Advanced Micro Devices) swing trade & shorter-term trade idea posted earlier has quite a few moving parts, not to mention the fact that I just posted several charts showing the semi-conductor sector at resistance. As such, I wanted to reiterate that while near-term & intermediate-term bullish on AMD (and personally long), a case was also made for a pullback in the semi-conductor sector which, if it does play out, could quite likely add some headwinds to the AMD long trade.

With that being said, it is not uncommon to see certain stocks moving against the overall trend of their sector. I also mentioned how being short SOXL while long AMD provides a partial hedge. Finally, while SMH is currently backtesting the recently broken uptrend line from below, it is not uncommon to see backtests continue for several days before prices turn back down.

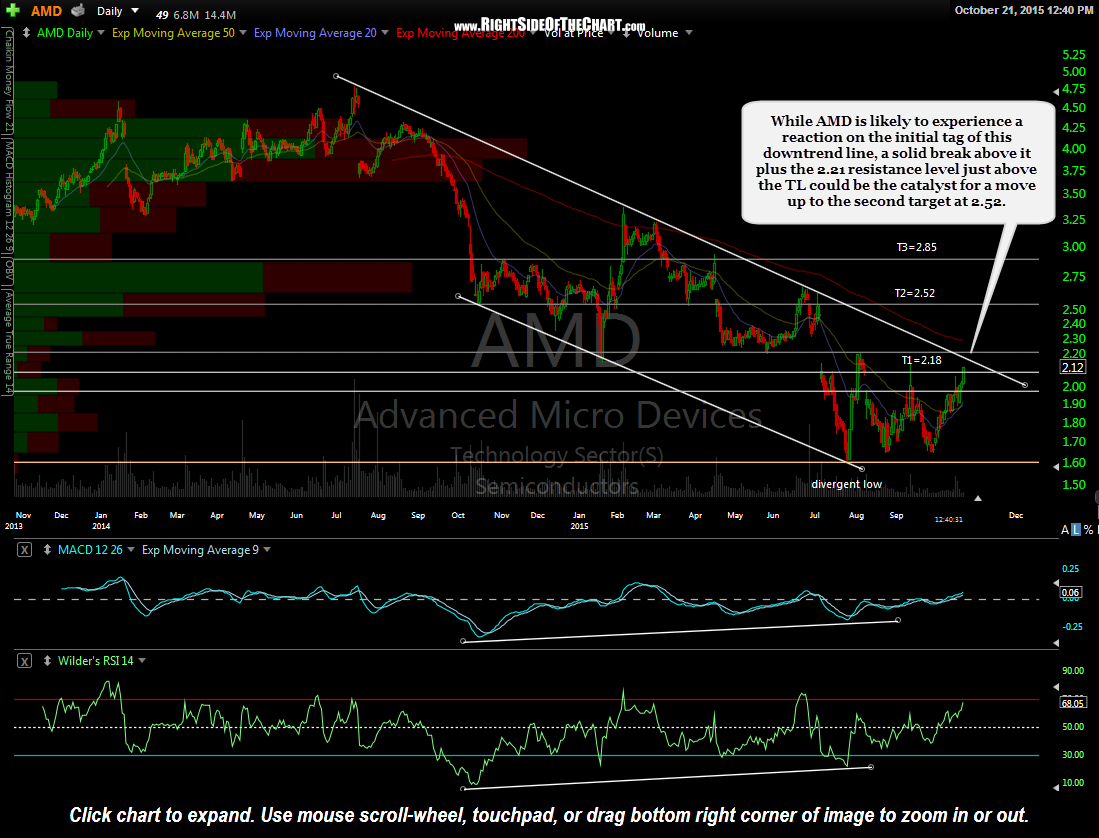

This daily chart of AMD highlights some of the salient technical levels, most importantly the downtrend line generated off the July 15 & 16 highs, as well as a significant horizontal resistance level which current comes in just above the downtrend line around the 2.21 level (which was also the first price target/resistance level shown on the 120-minute chart posted earlier. Once again, best to set your sell limit order a 2-3 cents below the actual resistance level to minimize the chances of missing a fill, should the stock reverse right at or just below the 2.21 level (also don’t forget that your sell orders are filled at the bid price & buy orders filled at the ask price, which is usually at least a penny higher than the bid).