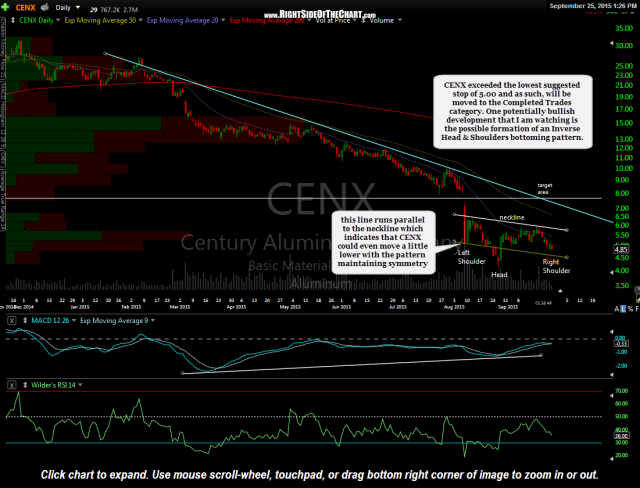

The CENX (Century Aluminum Co.) Long Trade Idea exceeded the maximum suggest stop on of a move below 5.00 on Wednesday and as such, will be moved to the Completed Trades category. However, for those still in the trade or considering a position, I plan to keep the stock on my radar to monitor this potential Inverse Head & Shoulders (IHS) bottoming formation.

Inverse Head & Shoulders patterns, just as with their counter-parts Head & Shoulders topping patterns, may have horizontal necklines as well as upwards & downwards sloping necklines. Although perfect symmetry is not required (and in fact, is very rare), an ideal IHS or H&S pattern should maintain some degree of symmetry.

I duplicated the neckline (changing the color to yellow) in order to make a parallel trendline which I then placed at the bottom of the left shoulder of the pattern. This shows us that if CENX is indeed in the process of putting in a right should of an IHS pattern, then prices could reverse anytime now or even move a little lower, still maintaining decent symmetry assuming they don’t fall too much below that yellow trendline.

Should CENX reverse & start moving higher soon, ideally we need to see an increase in volume as that is one of the confirming criteria for an IHS or H&S pattern. Once again, CENX will now be removed from the Active Trades category but may be added back as a new trade idea, should this pattern continue to develop.