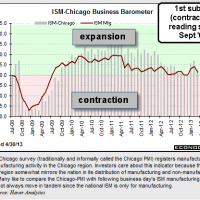

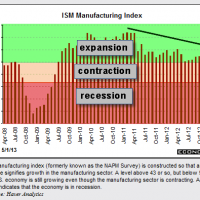

Looks like the market is off to the races today on a positive employment report. There’s a good chance that the IWM/TZA short trade as well as some other might be stopped out today but personally, I’m waiting until the the Factory Orders and ISM Non-Manufacturing Index Releases at 10:00 ET today before closing any short positions. The market very well may build on it’s gains but I continue to see a building disconnect between rising stock prices and deteriorating macro-fundamentals. To break that statement down a bit and clarify what I mean is that those metrics which are most important, the direct measures of economic output have nearly all been deteriorating for many months while the market chooses to dismiss those reports and rally on the improving trend in housing and employment. Fundamentally, I put a higher weighting on the former (direct economic output measures) is that housing and employment have pretty much had nowhere but up to go since 2009 but obviously I’m in the minority and that’s fine. There’s a time to actively engage the market and a time to keep things light so if we build on this mornings gains today, I will continue to unwind any short positions as their stops are hit but again, I’m waiting just a few more minutes before doing so (I did not realize that it would take so long to annotate these charts and make this post as I had tried to get it out sooner). Here’s the two direct measure of economic output that were reported this week, which like many others that I’ve pointed out recently, continue to diverge from the equity prices.

Results for {phrase} ({results_count} of {results_count_total})

Displaying {results_count} results of {results_count_total}