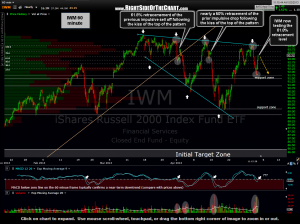

This chart is the same 120 minute IWM chart that I’ve been posting with the descending broadening top pattern only zoomed into a 60 minute time frame for clarity. I measured the retracements on the counter-trend mini-rallies following the two impulsive sell offs that ensued immediately following prices kissing the top of the pattern. It is very common to see counter-trend moves within a larger trend retrace between 38.2% – 61.8% of the previous move. In fact, we often see these counter-trend retracements actually turn down right at or very close to either the 38.2%, 50% or the 61.8% retracement levels (all key fibonacci ratios). The two previous initial counter-bounces stopped at the 61.8% & 50% retracement levels.

This chart is the same 120 minute IWM chart that I’ve been posting with the descending broadening top pattern only zoomed into a 60 minute time frame for clarity. I measured the retracements on the counter-trend mini-rallies following the two impulsive sell offs that ensued immediately following prices kissing the top of the pattern. It is very common to see counter-trend moves within a larger trend retrace between 38.2% – 61.8% of the previous move. In fact, we often see these counter-trend retracements actually turn down right at or very close to either the 38.2%, 50% or the 61.8% retracement levels (all key fibonacci ratios). The two previous initial counter-bounces stopped at the 61.8% & 50% retracement levels.

As this chart show, IWM has now retraced about 61.8% of the previous move down which began at the top of the pattern, which also coincides with that previous reaction low put in on Tuesday. If prices do exceed this level, we’ll need to watch the top of that pattern as so far, that downtrend line has capped all advances since the small cap index peaked back back in mid-March. Therefore, any solid break above the top of the pattern, especially a move exceeding the April 11th high, would be a bull technical event and call the current downtrend into jeopardy. Until then, the small caps remain in a confirmed downtrend but the current short trade faces some tough headwinds due to the strength in the more important, large cap indices. Even though the Russell 2000 has has been in a downtrend since short entry back in mid-March, the choppy, back & forth action has caused TZA to suffer from price decay so I will likely have to make a slight adjustment to the suggested stop and profit target to realign those figures with IWM. When trading leveraged ETF’s, I prefer to use the 1x (non-leveraged) tracking etf or the actual index itself when determining profit targets and stop level. Those updated levels will follow soon.