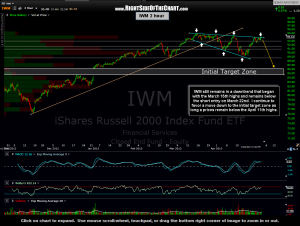

This chart was made just before the open today and shows that IWM continues to remain in both a downtrend as well as below the short entry back on March 22nd, despite the $NDX & $SPX having gained 2.5.- 3.5% since then. Although my expectation of a quick move to my downside target on the $RUT/IWM did not pan out, this trade still has a good chance of playing out IMO. However, a move above the April 11th highs in the $RUT/IWM will call the downtrend into jeopardy.

This chart was made just before the open today and shows that IWM continues to remain in both a downtrend as well as below the short entry back on March 22nd, despite the $NDX & $SPX having gained 2.5.- 3.5% since then. Although my expectation of a quick move to my downside target on the $RUT/IWM did not pan out, this trade still has a good chance of playing out IMO. However, a move above the April 11th highs in the $RUT/IWM will call the downtrend into jeopardy.

As far as the broad markets, I still don’t advise “shorting the market”, the market being the broad market…i.e. S&P 500 or any other broadly diversified large cap index. However, I do think the recent shorts on the $RUT (IWM/TZA), $NIKI (EWJ), financials (XLF or select TBTF banks) and energy (XLE or XOM & CVX) do offer an attractive R/R at this time, regardless of the recent resiliency of the $SPX and $COMP/$NDX. On a related note, irrespective of the current strong bid under the large cap indices, I am just not seeing many long setups offering objective entries at this time and I’d suggest being very selective on any new positions at this time, long or short.