My apologies for getting behind on updating the Short Trade Ideas. I had started to work on updating both the Short Setups as well as the Active Short Trades recently but was side-tracked with technical issues that forced me to spend over a hundred hours working on programming glitches with the back-end of the website due to some of the recent changes being made in addition to the untimely crash of my main computer used for both trading and running the site. My computer has been repaired and things seem to be finally be smoothing out on the site so I will once again turn my efforts to updating the trade ideas. Regardless to the Energizer Bunny Market that just doesn’t seem to want to quit, I still believe that the risk/reward is unfavorable for establishing new long positions and as such, the trade ideas remained considerably skewed to the short-side.

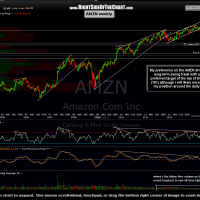

I’ll try to update the charts in order of relevance based on each trade’s current technical position. That brings me to the AMZN short which, although still profitable since the entry around 275 back in late January, has been an exercise in patience as the resiliency of the broad market has kept this overvalued, bloated pig of a stock afloat despite clearly bearish technicals. Any way, FF three months from that short entry and we finally have prices making a solid tag (and intraday break below) of the bottom of the channel that was listed as the first target. Actually, prices essentially hit that target back on April 5th or came within pennies but at this time, regardless of any short-term bounce off that support level, I still favor at least T2 on the daily frame (196.50) and will most likely keep this trade as a long-term swing short targeting the first target zone on the weekly chart (151-161). Note how the ascending channel on the daily chart is the same channel on the weekly chart, which if broken, would be a longer-term sell signal. As always, we need to see a solid weekly close (end of day Friday) below that channel in order to confirm the weekly sell signal. Updated daily & weekly charts below: