I’m going to run out for a bit & just figured that I share my thoughts on the previously stopped out HPQ short trade. I’m still watching for a break below that one minute uptrend line. Since the last post, HPQ had a sharp spike to new highs, which was more than likely the last major cluster of shorts all throwing in the towel and/or falling victims to a stop-raid by the big boyz. As such, I’m adding HPQ back on but only as a short setup at this time with an entry to be signaled if I see some solid technical evidence of a reversal.

I’m going to run out for a bit & just figured that I share my thoughts on the previously stopped out HPQ short trade. I’m still watching for a break below that one minute uptrend line. Since the last post, HPQ had a sharp spike to new highs, which was more than likely the last major cluster of shorts all throwing in the towel and/or falling victims to a stop-raid by the big boyz. As such, I’m adding HPQ back on but only as a short setup at this time with an entry to be signaled if I see some solid technical evidence of a reversal.

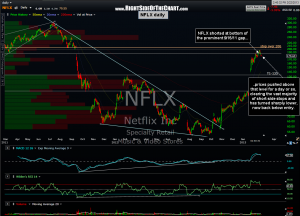

I liken HPQ to the recent NFLX short trade, which coincidentally was another recently successful long trade that was taken literally just days off it’s multi-year lows back in October (and closed out for a 60% gain one month ago tomorrow). The current NFLX short was entered while the stock was very extended and had run into the top of this very prominent gap. The stock went on to make what appeared to be a very convincing break above the bottom of that gap but sharply reversed a couple of days later and is now back comfortably below entry. I can’t be sure that HPQ will do the same but my best guess is that it might trade above the a day or two above top of that gap (19.10) for a day or so before falling back sharply. Here’s the updated NFLX daily chart for comparison. Still far too early to declare this one a winner yet but so far, it is playing out as expected.

I liken HPQ to the recent NFLX short trade, which coincidentally was another recently successful long trade that was taken literally just days off it’s multi-year lows back in October (and closed out for a 60% gain one month ago tomorrow). The current NFLX short was entered while the stock was very extended and had run into the top of this very prominent gap. The stock went on to make what appeared to be a very convincing break above the bottom of that gap but sharply reversed a couple of days later and is now back comfortably below entry. I can’t be sure that HPQ will do the same but my best guess is that it might trade above the a day or two above top of that gap (19.10) for a day or so before falling back sharply. Here’s the updated NFLX daily chart for comparison. Still far too early to declare this one a winner yet but so far, it is playing out as expected.