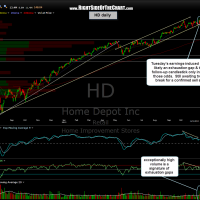

I was very close to shorting HD near the highs yesterday morning and adding it to the site as an active trade. If you recall, I posted the short setup on Monday, to be triggered on a break below the ascending channel/primary uptrend line. Before the open Tuesday, HD announced better-than-expected earnings and triggered what I felt at the time was most likely an exhaustion gap in the stock. As there were already a ton of active short trades on the site (and in my trading account), I decided to wait and see how the stock followed thru today. As you can see from the updated chart below, HD put in a bearish follow-thru candlestick today, completely back-filling that gap.

Having a gap back-filled in and of itself is not an uncommon occurrence but taken in light of the previously highlighted bearish technicals on this stock (click here to view the previous posts and charts), I believe the odds are very good that HD has likely put in a lasting top at or near current levels. However, my original short entry criteria remains and that would be on a break below the primary uptrend line (which is also the bottom of the more recent ascending channel). Of course a break below that level would also bring HD below the bottom of the gap, which would only add to the bearish case on HD as that level is now considered support.