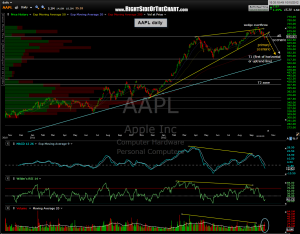

currently, AAPL is taking a stab at regaining that key 644 former break-out level, which is not surprising considering the recent short-term oversold condition of the stock. i am not too concerned with intraday levels today but more so how we close. obviously, a solid close above 644 on AAPL would be somewhat bullish (and viewed that way by most traders) but don’t forget that AAPL still has the recently broken bearish wedge to contend with, not far above that level.

currently, AAPL is taking a stab at regaining that key 644 former break-out level, which is not surprising considering the recent short-term oversold condition of the stock. i am not too concerned with intraday levels today but more so how we close. obviously, a solid close above 644 on AAPL would be somewhat bullish (and viewed that way by most traders) but don’t forget that AAPL still has the recently broken bearish wedge to contend with, not far above that level.

again, my expectation is that the selling will accelerate as we move lower in price but there will always be the typical counter-moves higher, especially in the early stages of a market reversal as the dip-buyers step in like Pavlov’s dogs to the dinner bell. here’s an updated daily chart of AAPL showing prices attempting to regain that 644 level (horizontal line) along with my primary and alternate scenarios (we either turn down around current levels or move up to re-test the wedge). again, how we close is more important than intraday levels IMO and although AAPL is the Big-Dog, we need to also keep an eye on the broad markets and other leading stocks as well.