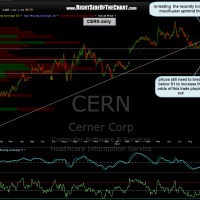

someone just inquired about the CERN short trade so here are a couple of updated charts, including a suggested stop level for those who originally took the trade and are targeting T2. in the previous update, i suggested a initial stop level for shorter term traders or those preferring tight stops. preferring more liberal stops at this time myself, and still short CERN, i will be using a move above the 78.60 area, which looks like decent resistance as shown on this 4 hour chart.

note how 4 out of the last 5 (80%) RSI 70+ (overbought) readings on that time frame have immediately lead to substantial corrections (the 5th did lead to a quick, but rather shallow pullback with prices quickly continuing higher. CERN would also offer a very nice R/R on a new short or add-on at current levels using the 78.60+ stop level ($1.60 downside vs. about $12.50 profit to T1 and a $19 profit to T2). i can’t promise the trade will work out but i can say that the R/R (risk vs. reward) on a trade doesn’t get much better than that, at nearly 12:1 to T2.