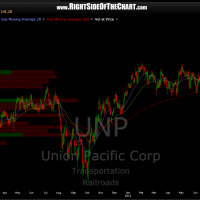

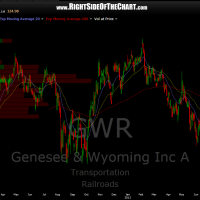

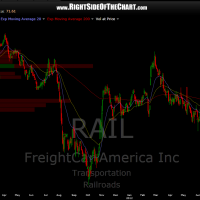

one “piece of the puzzle” that just didn’t fit in my whole “US economy is turning down” theory has been the undeniable strength of the railroad sector, until today that is. recently the dow jones industrial average broke out to new highs while the dow jones transportation sector hasn’t even come close, thereby giving a dow theory non-confirmation warning sign. however, i was puzzled to see the railroad sector making new highs as recently as last week. yes, FDX, widely considered the “canary in the coal mine” for the US & even global economy has been guiding lower and telling us outright (verbally & technically) that the economy was weakening. this slowdown has been evidenced by all the sub-sectors (trucking, airlines, etc..) of the transports except for the north american railroads, which are usually a good indicator of economic activity as they transport the goods that we buy and sell.

enough about that. i’ll let the charts below speak for themselves. this type of sudden and powerful reversion to the mean is what i continue to expect the US stock market to do as soon as the masses realize that it’s not really different this time around just because the fed has announced QEternity and that fundamentals DO actually matter. the larger the disconnect gets, the more powerful the mean reversion will be, as the derailing of the railroad sector today illustrates.