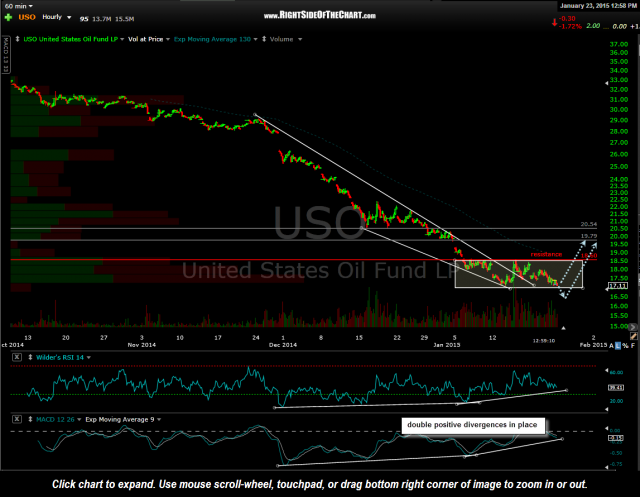

Although it’s too far too early to say the most recent scenario (posted on USO will continue to play out (with a move up to the 19.80 level & possibly beyond), so far we have seen prices break below the recent trading range only to reverse shortly afterwards & moving impulsively higher since regaining the bottom of the range.

In yesterday’s mid-day market/long trade ideas update, I had mentioned that the UCO/USO long trade would be considered stopped out but that updates on USO would continue. I had also mentioned that USO had broken below the recent trading range on the 60-minute chart, which was the preferred scenario first laid out last Friday (first chart below). What I had meant to add to yesterday’s update was that the 5 energy stock trade ideas (NOV, QEP, RIG, SFY, & SLB) were intentionally left on as both Trade Setups & Active Long Trade ideas, as the charts remain constructive and the USO flush-out/bear-trap scenario still looks likely. My apologies for now catching that oversight until now.

- USO 60 minute Jan 22nd

On a related note, my efforts have recently been focused on the back-end (programming) of the site. In order to provide for a more streamlined process when viewing all new posts on the home page or within a specific category, a brief excerpt of each post will be displayed. The time & date of each post, as well as any category(ies) and symbol tag(s) associated with each post are now located at the bottom of each full post or excerpt. Clicking on any of the categories or symbol tags will bring up all associated post starting with the most recent. To view the complete post and all associated charts, either click on the title of the post or click the “…continue reading” link at the end of the excerpt.