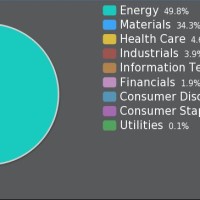

O Canada, you look so bullish… at least your lower quality stocks do. The $CDNX (S&P/TSX Venture Composite Index) is a broad market indicator of Canadian micro cap securities. Being a largely natural resource based-economy, the bulk of the components of the $CDNX are energy and mining companies, with energy stocks comprising roughly half the index and materials (including mining stocks) representing just over a third of the index (see sector breakdown chart below).

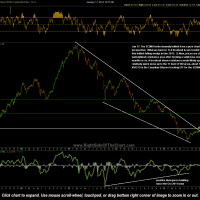

A couple of considerations for those interested in trading or investing in the $CNDX: As a rule, micr0-cap and venture companies should be considered high-risk, volatile companies. Although this risk is somewhat mitigated through the diversification amongst many companies (218) and various sectors, this index is still prone to large price swings in either direction, as evidenced from the 65% plunge in the $CDNX from the March 2011 peak to the June 2013 lows. Another consideration is the fact that I could only find one tracking ETF for the $CDNX, ticker symbol XVX.TO (iShares S&P/TSX Venture Index Fund ETF), which trades on the Toronto Stock Exchange. However, most US brokers will allow US account holders to trade securities listed on the TSX, although there may be additional fees & typically, those securities such as the XVX.TO, must be purchased in a taxable account (no IRAs). Best to consult your broker for details if interested. Apparently the only US exchange traded fund (TSXV) is no longer trading. If anyone knows of any other trading instruments that track the $CDNX, please contact me and I will pass it along. Details on the $CDNX, along with a complete list of all 218 constitutes of the index, may be found by clicking here. The live, annotated charts of the $CDNX and the XVX.TO may be viewed by clicking on these symbols. XVX.TO will be added as a Long Trade Setup as well as a Long-term Trade Setup with an entry to be triggered on a daily close of the $CDNX above 980 (the horizontal resistance level).

- $CDNX daily Jan 17th

- XVX.TO daily Jan 17th

- $CDNX Sector Breakdown