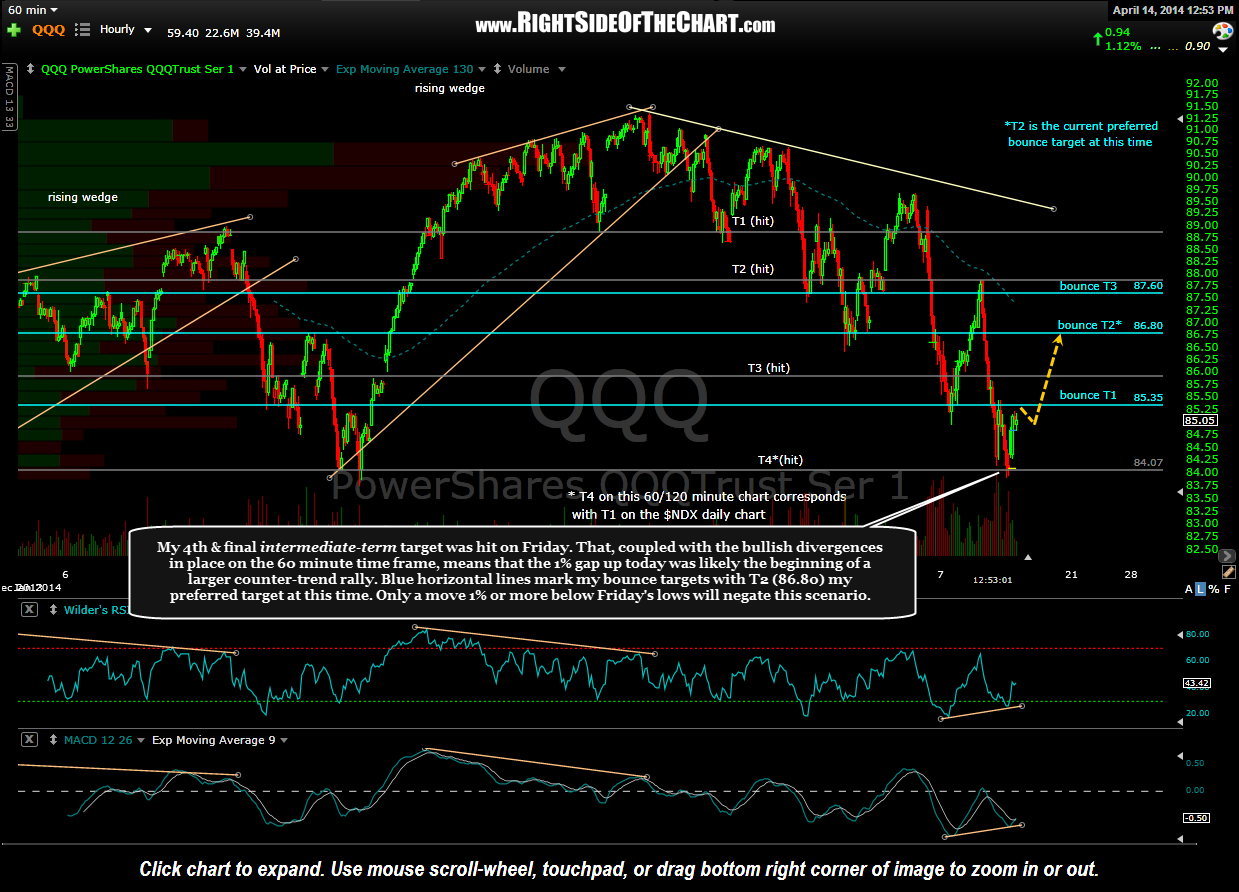

My 4th & final intermediate-term target was hit on Friday. That, coupled with the bullish divergences in place on the 60 minute time frame, means that the 1% gap up today was likely the beginning of a larger counter-trend rally. Blue horizontal lines mark my bounce targets with T2 (86.80) my preferred target at this time & T3 (87.60) my current final target. Only a move 1% or more below Friday’s lows will negate this scenario. Keep in mind that I took us a while to get down here and so it might take several days, possibly weeks, to retrace a third or half of the move down from the March 7th peak in the $NDX/QQQ (my 2nd & 3rd targets come in around the 38.2% & 50% Fibonacci retracement levels of the entire move off the highs). As such, the market updates might be light for a while unless anything significant develops.

Just to clarify, a preferred target on RSOTC is the profit target on a trade which hits the “sweet-spot” on the R/R curve whereas the final target is the level at which the R/R on the trade no longer remains clearly skewed in the direction of that move. Typically, but not always, the final target is the level at which I believe a trend reversal is likely as well. I will often book full or partial profits at my preferred target while I will always book full profits at my final target, assuming that I still hold some or all of the position.