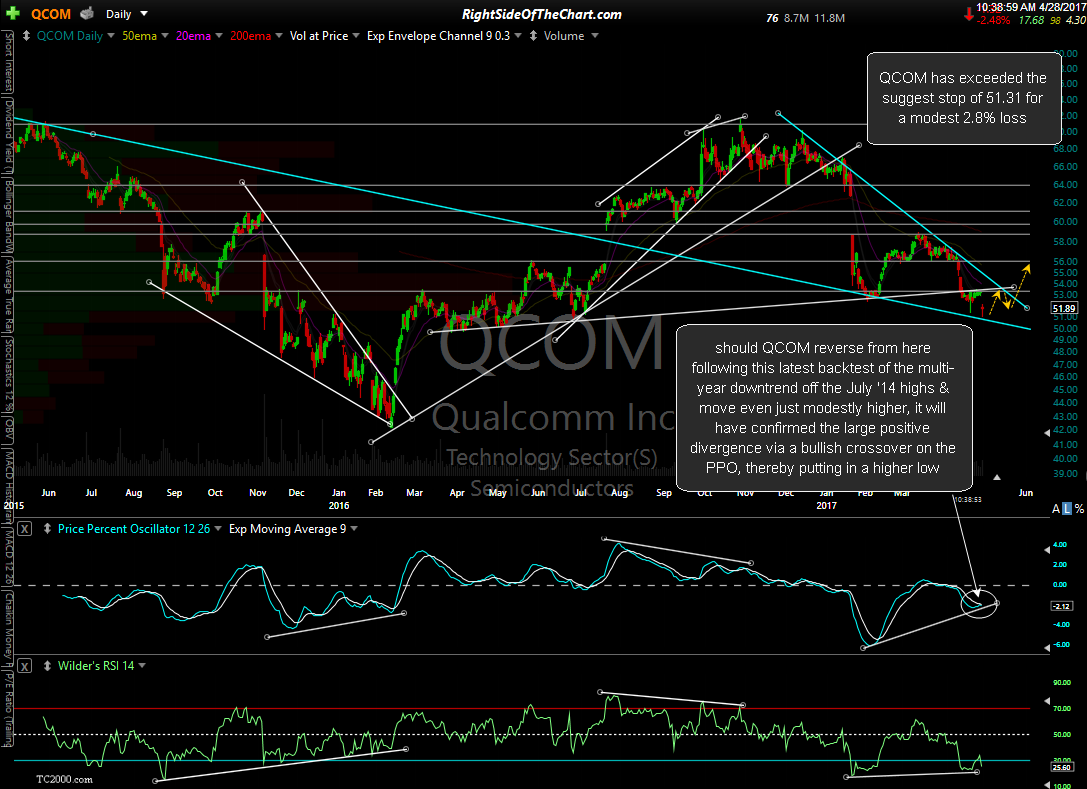

QCOM (Qualcomm Inc) has exceeded the suggest stop of any move below 51.32 for a modest 2.8% loss with the stock trading down in sympathy with the semiconductor sector today following a disappointing earnings report and/or forward guidance from the industry leader, INTC (Intel Corp) after the closing bell last night. So far today, after a brief & relative shallow run below the tightly placed stop, QCOM has hammered off the multi-year downtrend line generated off the July 2014 highs. Should the stock move even just modestly higher from here, it will have confirmed the large positive divergence on the indicators below via a bullish crossover on the PPO (which will have put in a lower high on that indicator, thereby confirming this potential divergence).

I shared my thoughts on QCOM in the trading room earlier which was: If I had taken QCOM as a pure-play long instead of a hedge to my current sizable short position on the semiconductor sector, I would have let the stock go when the stop-loss price was hit. Since I took this trade as much as a hedge to my short positions as what appeared to be an objective long entry with an attractive R/R, I’m going to give it a little more room. However, as this trade exceeded the suggested stop, it will now be removed from the Active Trades category & reassigned as a Completed Trade. On a related note, my expectation for a considerable correction in the semiconductor sector as a whole in the coming months has not diminished in the least.