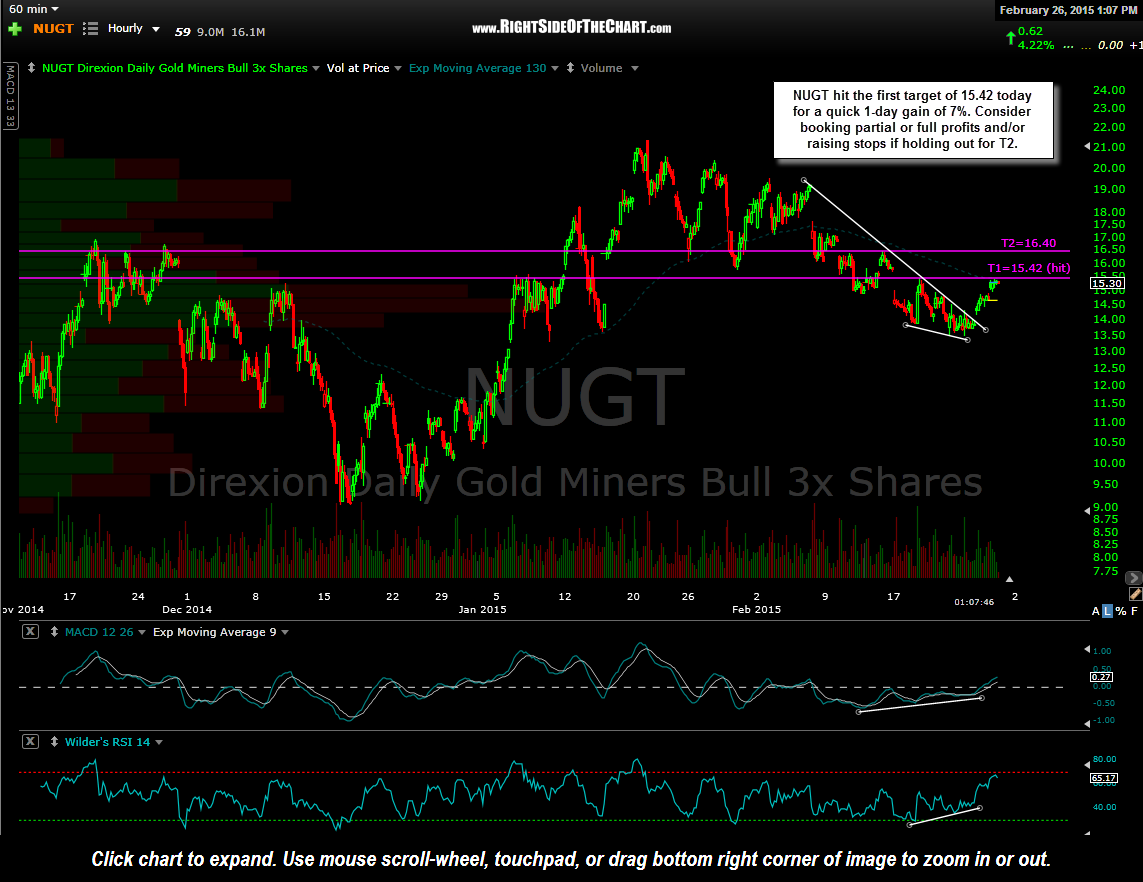

NUGT (3x long gold miners etf) hit the first target of 15.42 today for a quick 1-day gain of 7% in the regular trading session as well as exceeding that level in pre-market trading today. Consider booking partial or full profits and/or raising stops if holding out for T2.

While NUGT hit the first target in both pre-market & the regular trading session today, GDX hit & excceded T1 (21.16) in the pre-market session but they have kept prices literally one cent below the target on three separate attempts today. Although GDX still has a good chance of reaching T1 & moving on to at least T2 over time, the price action in GDX today helps illustrate the point that I made before the market opened today as to why it makes sense to allow you sell limit orders to be filled in the extended-hours trading session (post & pre-market trading hours) as now that GDX has already hit the actual resistance level that I was targeting (the top of the Feb 14-17th gap), there is always the possibility that was the end of the run for GDX (but again, I reiterate that is not my current belief).

The top of that gap was 21.20. GDX was trading at 21.22 in the screenshot that I took & posted before the open today which means that the gap was already backfilled. The initial tags of support & resistance, usually in the regular trading session but quite often in the extended hours sessions as well, often mark inflection points, with the stock pulling back off resistance (or bouncing off support). Hence, if I am targeting a particular support or resistance level as my price target to take partial or full profits, I will always do so on the first tag of that level and even then, with my sell limit order set slightly below the actual resistance level in order to avoid these shenanigans that the market makers and other institutional player engage in from time to time, like keeping the price of a stock down just below where a bunch of sell order are stacked or pushing a stock (they wish to accumulate) just below a key support level in order to run the stops and shake out the sellers (which is why my stop-loss orders are placed somewhat below the actual support levels but not too close).