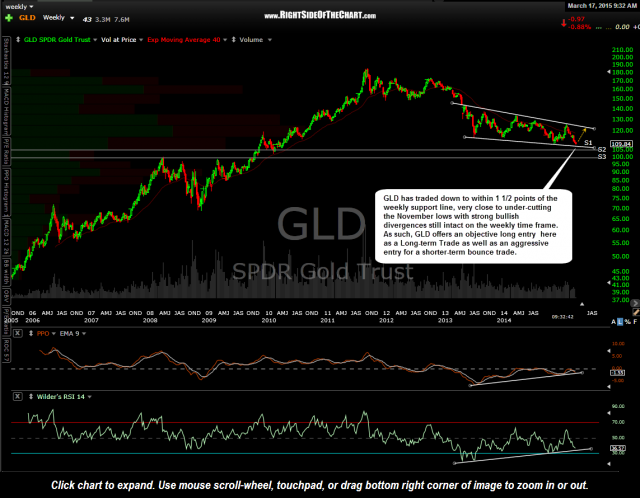

Gold prices are now approaching the bottom of the long-term descending-contracting channel as recently discussed in the March 4th Gold & Gold Mining Sector video. To recap, following the recent near-term bearish price action in gold, I discussed one likely scenario to be for gold to slightly undercut the November lows while moving down to the bottom of that large descending channel/falling wedge pattern on the weekly chart. As this would give us a new multi-year low in gold, seen as very bearish by most & likely to shake out some longs & draw in a new wave of shorts, that could help set the stage for a final washout move in gold prices.

As I type, the LOD (low-of-the-day) following the gap down in GLD (gold ETF) is 109.78 so far, still just slightly above the November 5th low of 109.67. Today’s low (so far) in GLD is also about 1 1/2 points above the bottom of that weekly descending support line which comes in around 108.34 today (and decreases slightly every day due to the negative slope of the line).

Therefore, while I could certainly see a little more downside to hit & even briefly pierce that support line, I believe that gold (GLD) offers an objective long entry or add-on for long-term trend traders & investors. Aggressive swing traders could also take a long position in GLD here as well with the appropriate stops below in an attempt to trade a bounce off this support level that is likely to last at least a few days, if not several weeks or more.

Bounce targets for both trades (long-term as well as a shorter-term bounce trade) will follow. As such, GLD will be added as an Active Long-term Trade Idea & Setup as well as an Active Long Trade & Setup. Again, targets on both trades to follow soon. The suggest stop for the Long-term Trade will be on a weekly close greater than 1 point below the bottom of the descending support line. That would correlate to about a stop below 107.60 should GLD close below that level this Friday (the TL comes in on Friday around 108.60).

Note: Aggressive swing traders only looking to play a bounce lasting several days or weeks might opt to use gold futures, DGP (2x long gold ETF), GDX or possibly NUGT, depending on your expected holding period and risk tolerance. An alternative, somewhat more conservative entry would be to wait for some evidence of a potential trend reversal, such as some type of bullish reversal candlestick pattern.