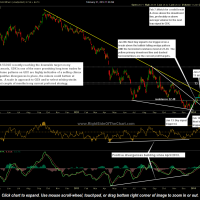

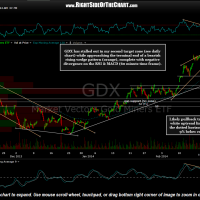

As mentioned last week, I booked profits on the bulk of my gold & silver mining stock positions and even closed some additional mining trades out this week, virtually closing out all my exposure to the sector (save a few small long-term positions). Since hitting my second target zone (T2 on the daily chart) a week ago today, GDX has stalled out with prices contracting within a bearish rising wedge pattern as shown on the 60 minute chart below. The fact that the mining stocks have made a very powerful & relentless advance, gaining about 30% since the well-timed post on Dec 31st titled Time To Start Buying Gold , while also forming a bearish rising wedge pattern, complete with negative divergence on the MACD & RSI, greatly increases the odds of a near-term correction in the sector. Yes, the momentum in the mining sector is very strong & yes, the miners could just power through this resistance zone & shorter-term bearish pattern but trading is all about the R/R (risk to reward ratio) and at this time, the R/R is no longer clearly skewed to the bullish side IMO.

- GDX daily Feb 21st

- GDX 60 minute Feb 21st

Longer-term I continue to remain bullish on gold, silver and the mining sector but as a more active trader, my preference is to book profits and protect my gains even if that means losing out on additional gains, should the sector move sharply higher before any meaningful pullback. The live charts on all of the mining stock trade ideas, which can be found on the Live Charts page, were updated earlier this week but I still haven’t found the time to remove those trades that have hit their final targets from Active Trades category. Those trade should be moved to the Completed Trades category soon. I will also review the remaining active trade for objective entry levels, should we get a half-decent pullback in the mining stocks.

Have a great weekend! –RP