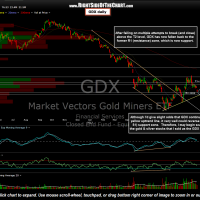

GDX has now fallen to the yellow uptrend line as discussed as the most likely scenario on Tuesday. Therefore, GDX offers an objective long entry, add-on or re-enter here with stops somewhat below the 25 area. The previous & updated daily charts are below followed by the 60 minute chart which showing how GDX has also fallen to a Fibonacci support cluster (the 61.8 & 78.6% retracement levels). Although I do believe the odds for a tradeable bounce, possibly much more, from at or near current levels are good, I do still see some ambiguity on the charts of many of the individual components in the mining sector. My preference would be to see strong divergences in place with most of the key stocks in the sector approaching well-defined support levels. There are numerous gaps at or below current levels on many of the charts and as such, the price action is likely to continue to be very volatile in this sector. As before, my preferred approach is to scale into these positions vs. diving into a full position at once. The smaller-than-usual position sizes help to allow for the wider stops needed to be able to swing trade such volatile stocks & with the increased profit potential ( many of the recent gold trades where closed for 30-50%+ gains), the smaller position size still has the potential to produce typical to above average gains, if successful.

I plan to follow up with some individual mining stock trade ideas asap. I have been utterly & completely preoccupied with programming changes to the site this week but most of the issues have been resolved and I should be able to return my focus to posting some new trade ideas as well as cleaning up the active trades lists to remove some of the stopped out trades. Please note I am aware that the contact page in not functioning properly but we expect to have that feature restored soon.