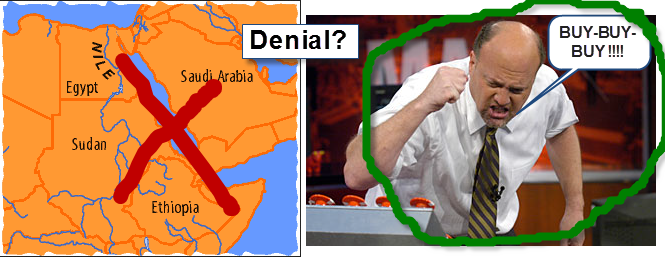

As Mark Twain once said; “Denial ain’t just a river in Egypt”. Although he spoke (or penned) those words over 100 years ago, that statement is every bit as relevant and true today as it was back then. Having devoted my entire adult life to learning all I can about the financial markets, one truism that never fails is that at, and even for a while after a market top, there is an unwavering belief by the masses that things really are different this time and the party will never end.

As Mark Twain once said; “Denial ain’t just a river in Egypt”. Although he spoke (or penned) those words over 100 years ago, that statement is every bit as relevant and true today as it was back then. Having devoted my entire adult life to learning all I can about the financial markets, one truism that never fails is that at, and even for a while after a market top, there is an unwavering belief by the masses that things really are different this time and the party will never end.

Wikipedia defines denial as: Denial (also called abnegation) is a defense mechanism postulated by Sigmund Freud, in which a person is faced with a fact that is too uncomfortable to accept and rejects it instead, insisting that it is not true despite what may be overwhelming evidence. I’ve been trading and investing long enough to know that my analysis has been wrong before and will be wrong again but I believe that the evidence that stocks are due for at least a sizable correct is “overwhelming”. Maybe I’m the one in denial here and a historic milestone has been reached, one in which the global central banks have finally discovered the holy grail of economics. The discovery that the stock market can be lifted indefinitely via money printing (counterfeiting) and selling one maturity of bonds to buy another (shell games). I was quite surprised that the Fed or ECB (or both) were not awarded this year’s Nobel Peace Prize for such an historic achievement although it did go to the EU for it’s, and I quote: “advancement of peace and reconciliation, and to applaud its solidarity as it continues to work to contain the debt crisis hanging over the euro zone”… lest you think I’m kidding about any of this. Just think of the implications of such a monumental discovery: Now that the US and EU have figured out how to eliminate any recessions and prevent any future stock market declines, soon that wisdom will spread to the rest of the world and even countries like Zimbabwe, Haiti and Afghanistan will fire up the printing presses and join the rest of the world in perpetual prosperity… -OR- I don’t want to continue to beat a dead horse as I believe that I’ve made more than a solid case supporting at least an intermediate top in equities, if not a longer-term (i.e.-bear market) top. That case has been made Ad nauseam from both a fundamental and technical perspective over the last few months in various charts, commentaries and videos which can be found in the General Market Analysis section of the site. However, if my opinion proves to be wrong, the charts should gradually point that out as the technicals and market action change from bearish, to neutral, to bullish while the market goes onto new highs, which are only about a mere 3 1/2% higher on the S&P 500, therefore providing one of the best risk to reward shorting opportunities seen in years.

The markets will soon reach what I call the Point Of Recognition, colloquially known as the “Oh sh*t” moment; that point in time where one abruptly realizes that things are no longer going according to plan and that it’s too late to abort without suffering severe casualties.

The markets will soon reach what I call the Point Of Recognition, colloquially known as the “Oh sh*t” moment; that point in time where one abruptly realizes that things are no longer going according to plan and that it’s too late to abort without suffering severe casualties.