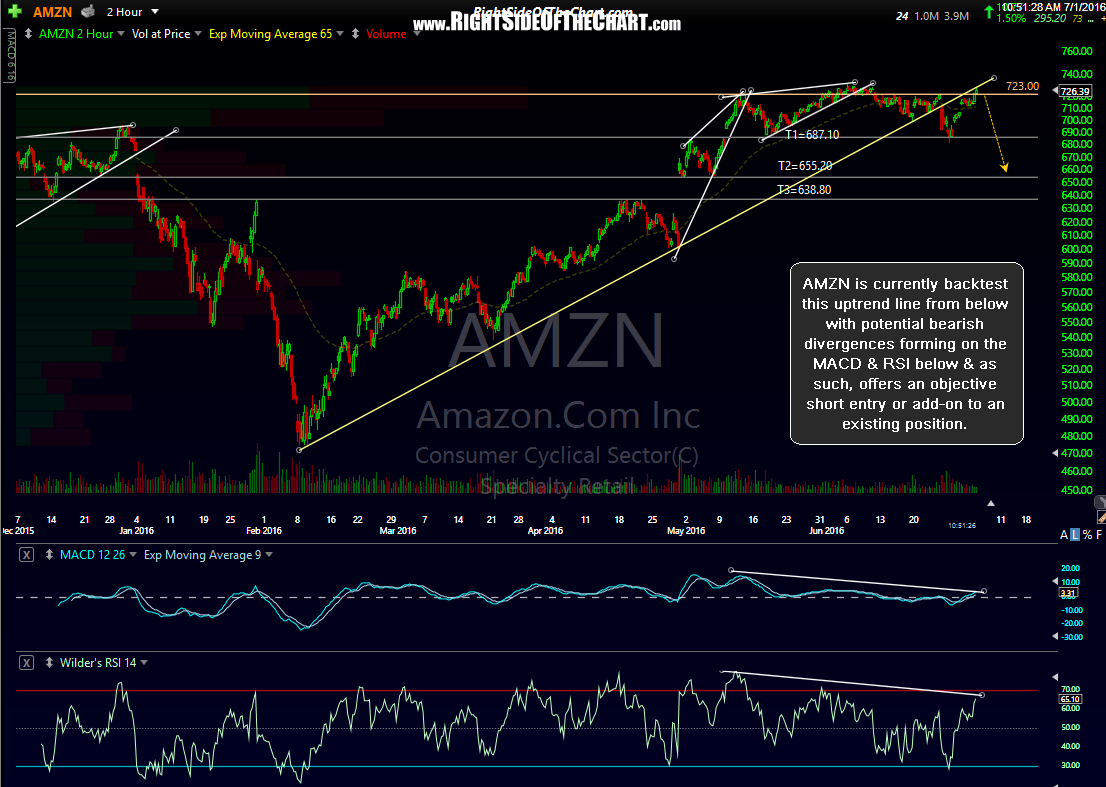

The AMZN Active Short Trade is currently backtesting the uptrend line off the early February lows, which the stock broke down below about a week ago. The point of this update is two-fold: First, to highlight the fact that regardless of what the broad market is doing today, AMZN offers an objective add-on or new short entry here on the backtest of that uptrend line and second, I also wanted to update the trade & add an official maximum suggested stop.

In the original trade entry back on May 13th, a stop above 723 was suggested for the early targets (T1 & T2) while those targeting T3 or even a larger move down (which is still very likely based on the longer-term charts) could allow for wider stops. I did an update on several trade ideas, including an in-depth review of the AMZN trade in this Active Short Trades video on May 31st, discussing the reasoning keeping the trade active, even if the 723 level is breached.

However, at this time we need to set a hard maximum stop on AMZN, again for those targeting T3 or any additional targets that might be added if the trade is not stopped out first. Taking into account the charts of QQQ as well as AMZN, the max. suggested stop will be on any 60-minute (candlestick) close above 730.40, which still offers an attractive R/R of slightly better than 3:1 to the final target (and a much better R/R those shorting a new position or adding to an existing position here on the backtest).

I will also add that 730.40 is slightly above the June 6th high of 731.50 & should AMZN manage to slightly take out that high & then fall back below it (with a decent pullback), that will have put a confirmed bearish divergent high on the stock as both the MACD & RSI are lagging behind price as AMZN approached those recent highs. As such, those if I were to have shorted AMZN here (which I would if I did not already have a position), I would allow for a somewhat more liberal stop, using a 3:1 or better R/R to my preferred price target.

From the private messages & trading room questions & comments that have been coming in the last few days, I realized that very few are interested in shorting at this time and if so, never pull the trigger on a trade that you are not comfortable with. I will say, however, that I would be remiss not to point out the fact that AMZN still offers a very objective short entry here based on both the longer-term & shorter-term technicals, despite the recent rally in the broad markets.