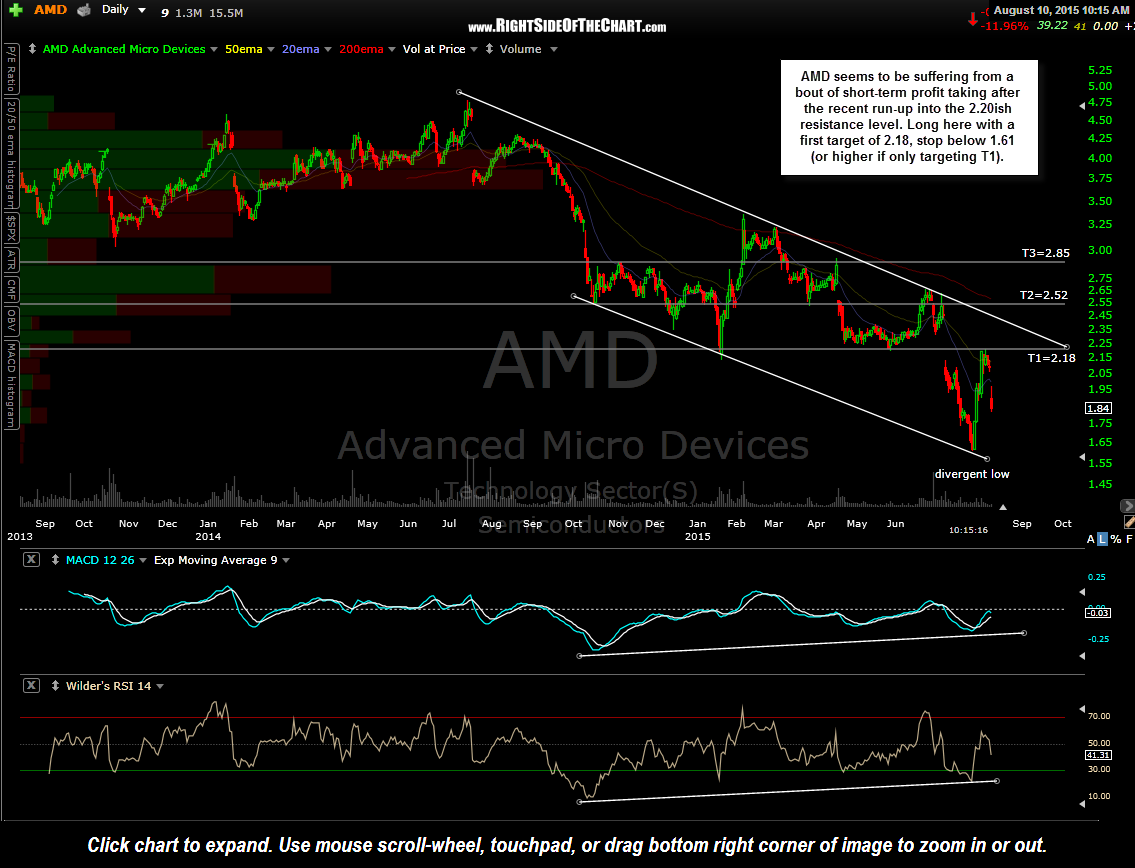

AMD (Advanced Micro Devices) seems to be suffering from a bout of short-term profit taking after the recent run-up into the 2.20ish resistance level. Long here at 1.84 with a first target of 2.18, stop below 1.61 (or higher if only targeting T1).

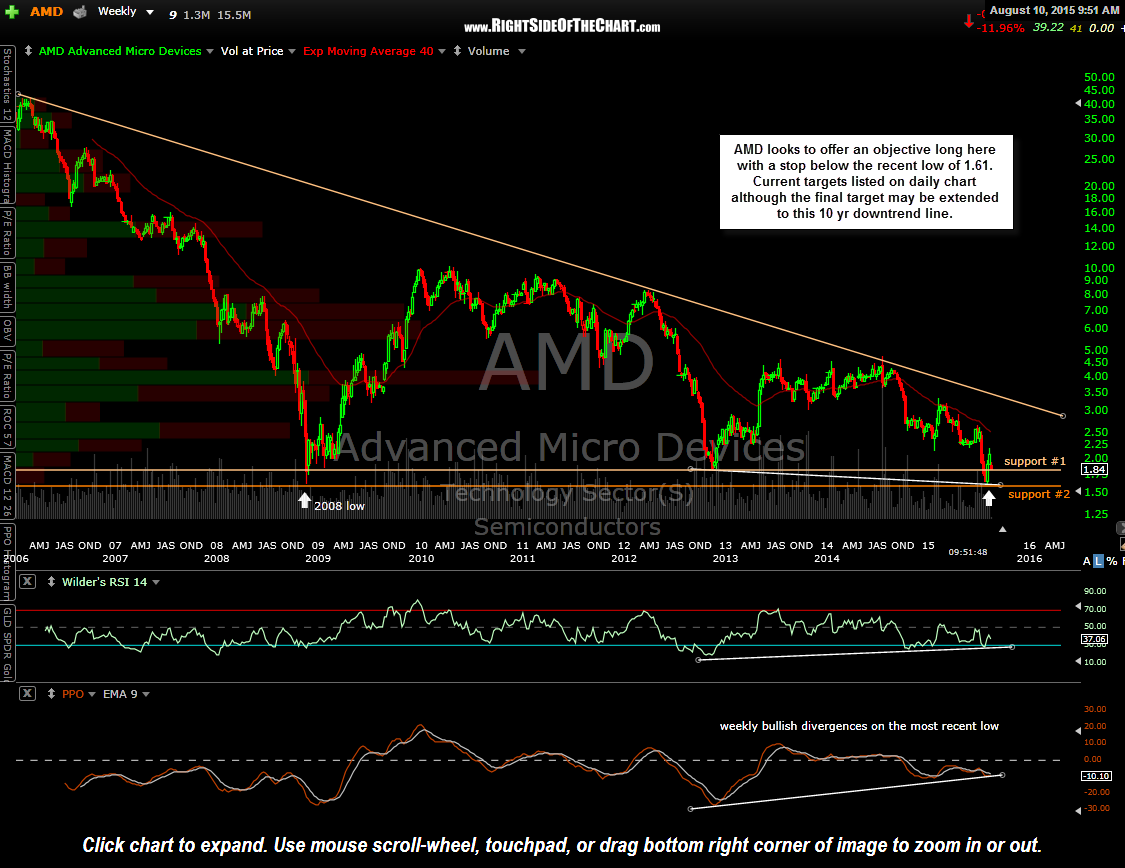

As the weekly chart below shows, AMD recently broke below the first long-term horizontal support level around 1.85 and rand down to the final key support level which is defined by the 2008 lows (as well as the most recent reaction off that level). That potential wash-out move printed a divergent low on the weekly time frame as well as the daily time frame. With AMD currently trading back around the 1.85 support level & down sharply today, the stock offers an objective, albeit somewhat aggressive long entry here. Going long AMD also provides a potential hedge to any semi-conductor shorts, including the INTC & AVGO Active Short Trades.