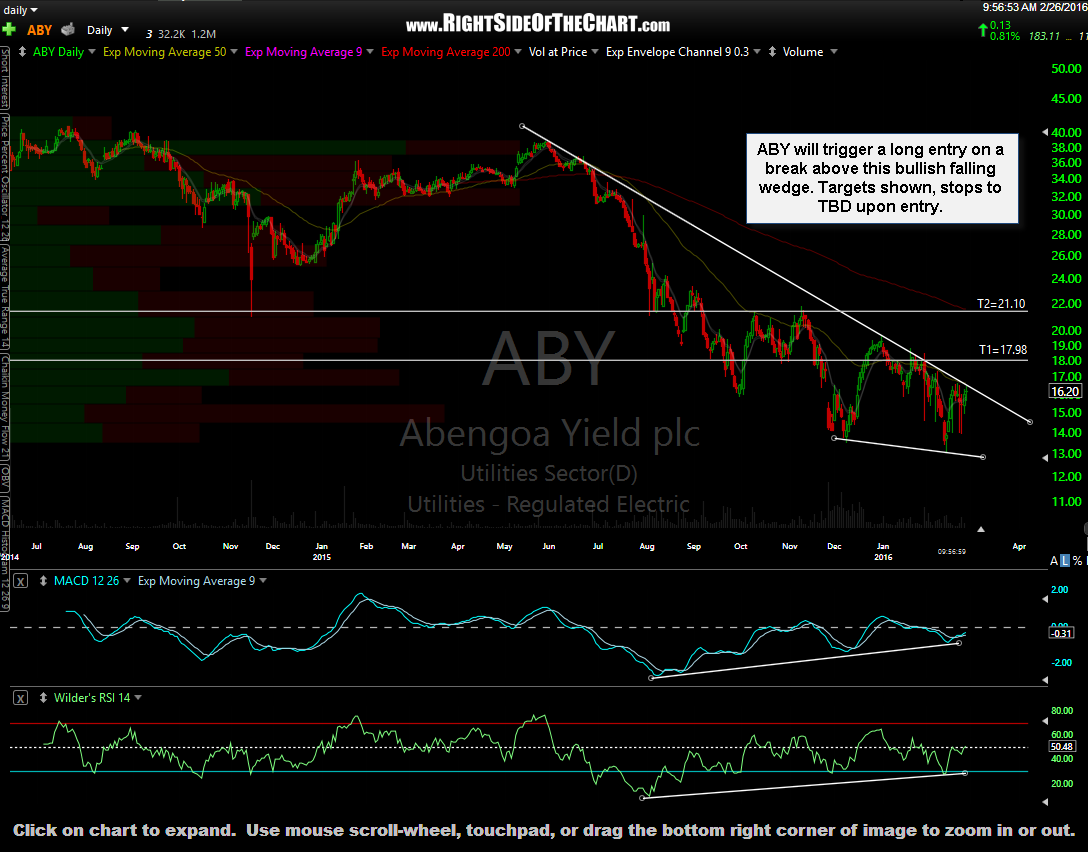

ABY (Abengoa Yield plc) will trigger a long entry on a break above 16.68, which is a minor horizontal resistance level just above this bullish falling wedge pattern. Waiting for the 16.68 level to go instead of taking the first breakout above the wedge offers a slightly less favorable entry price but considerable diminished the odds of failed breakout. With a current dividend yield of approximately 11%, ABY will be added as both an Long Trade Setup (i.e- a typical swing trade) as well as a Growth & Income Trade idea. Targets shown, stops to TBD upon entry.

Business Summary: Abengoa Yield plc owns a portfolio of contracted renewable energy, power generation, electric transmission, and water assets in North America, South America, and EMEA. It has approximately 20 stable contracted assets, including 1441 megawatts (MW) of renewable generation assets comprising concentrating solar power and wind plants; 300 MW of conventional power generation assets that produce electricity and steam from natural gas; 1,099 miles of electric transmission lines; and desalination plants. The company was incorporated in 2013 and is based in Brentford, United Kingdom. Abengoa Yield plc operates as a subsidiary of Abengoa, S.A. -source: Yahoo Finance