AAPL (Apple Inc) has now fallen to horizontal support where a reaction (i.e.- bounce and/or consolidation) is certainly possible although I have no interest in trying to play a bounce in the stock. In fact, I am short the QQQ’s (in which AAPL is by far the largest component) and with both the intermediate & short-term trends currently bearish, my preference at this time is to sell the rips, not buy the dips.

With that being said, I realize that my bearishness on AAPL places me in an extremely small minority, whereas the majority of traders & investors typically view any pullbacks as buying opportunities and as my analysis may prove to be wrong, I figured that it was worth pointing out the fact that AAPL is now trading at a decent horizontal support level, for those looking to initiate or add to a position in AAPL.

I became bearish on AAPL on April 28th, the day the stock printed its all-time high (April 28th Bearish Engulfing Candlestick In AAPL post) at that time listing two likely downside targets, the first of which has already been hit and my preferred pullback target still the 115.25 area. Not surprisingly or coincidental, the scenario posted back then (which is still in play) meshes with my bearish scenario for the QQQ & SPY (of which AAPL is also the largest component) as well as the recent $VIX & $VXN volatility index scenarios.

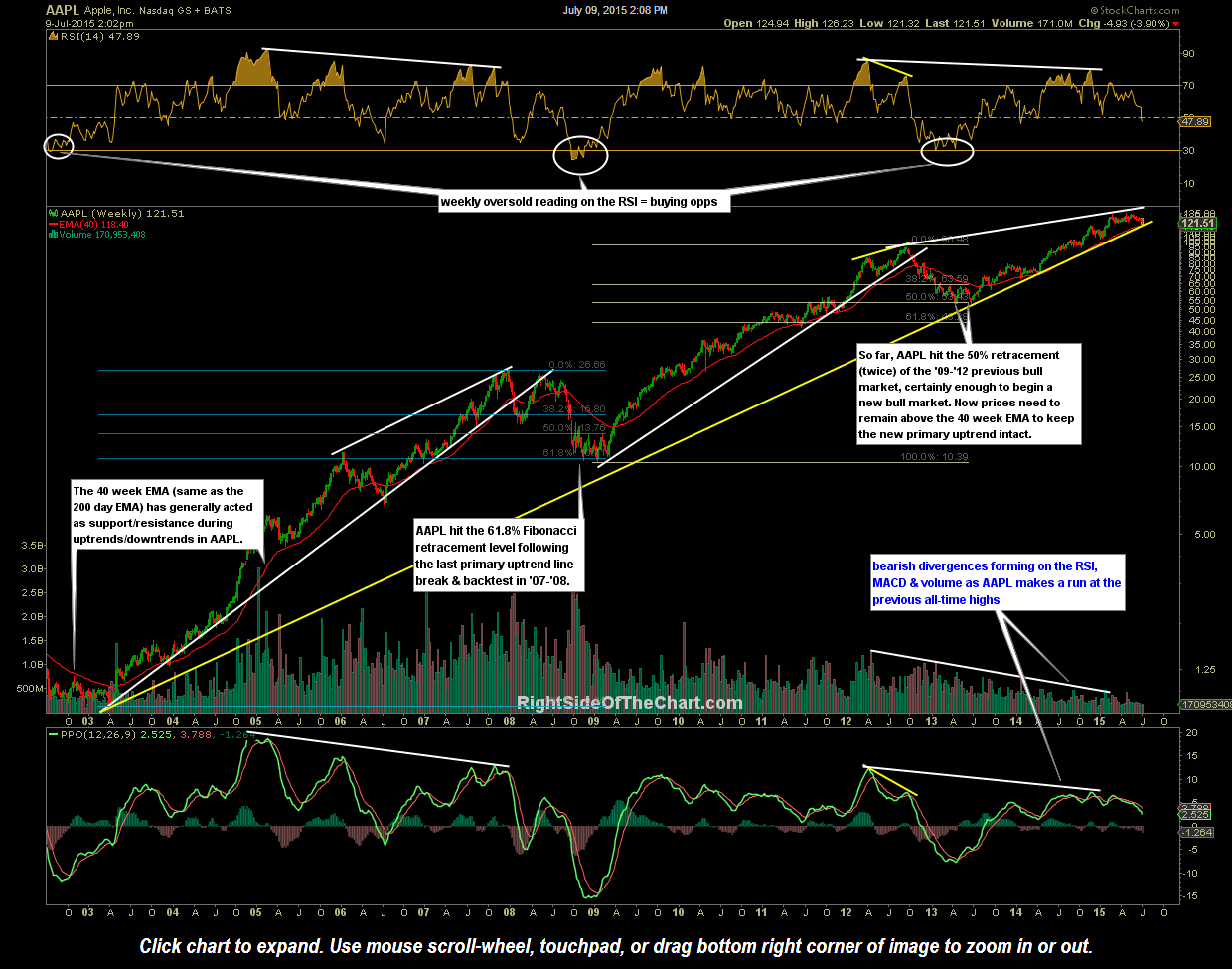

If I were to go long AAPL here, I would use a stop based on a close below the 200-day ema, which lies about 2 1/2% below current levels. Historically, the 200-day ema has done an nice job of acting as support in the stock. As pointed out in the past, the 40-week ema on AAPL (which is the same as the 200-day ema) has helped to define bull & bear markets in the stock for years. In line with my previous post highlight how many of the major US equity indices are trade at or near their primary bull market uptrend lines, this 13-year weekly chart of AAPL tells the same story: Not only is AAPL currently testing it’s secular bull market trendline (generated off the April 2003 lows) but the 40-week ema happens to come in just below current levels as well. This puts AAPL in a precarious technical position from not just a short-term perspective but a long-term perspective as any solid (weekly) close below those interesting support levels would unarguably be a bearish technical event in the world’s largest publicly traded company.