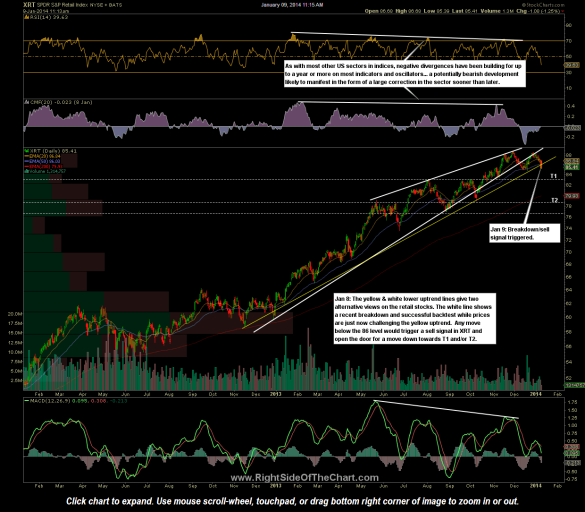

As expected, it didn’t take long (less than 24 hours since yesterday’s post) for the retail stocks to break down. In addition to the four existing Active Short Trades that are components of XRT (COST, RAD, ORLY & NFLX), four additional retail stocks have been added as new trade setups so far today: ABG, SSI, BES, & CVS. (note: Email notifications were not sent on all of these but they can be viewed by visiting the site).

There are still about a dozen retail stock on my watchlist that have either recently broken down or are approaching key support levels. In trying to keep the trade ideas more streamlined in 2014, I plan to be a little more selective with the trade ideas but for those interested in some additional retail stocks that look poised for a correction, you might want to check out KR (currently sitting on uptrend line support following the recent divergent high), BBY (recently broke below the uptrend line generated off of the April 3, 2013 low and is probably on the way to back-fill the gap at the 32.00 level, about 16% lower), SWY (sitting just above uptrend line support following the recent divergent high), GNC (recently broke down from a bearish rising wedge generated off the Jan 3, 2013 lows and likely headed for the 48 area, about 16% lower), GME (just bounced off the uptrend line from the Aug 2, 2012 lows after peaking with a divergent high in mid-Nov). There are a few more that I’m watching which I may add, along with some of these names just mentioned as official trade ideas soon as well. For now, I just wanted to share these trade ideas for those interested in some short trade ideas in the retail sector.