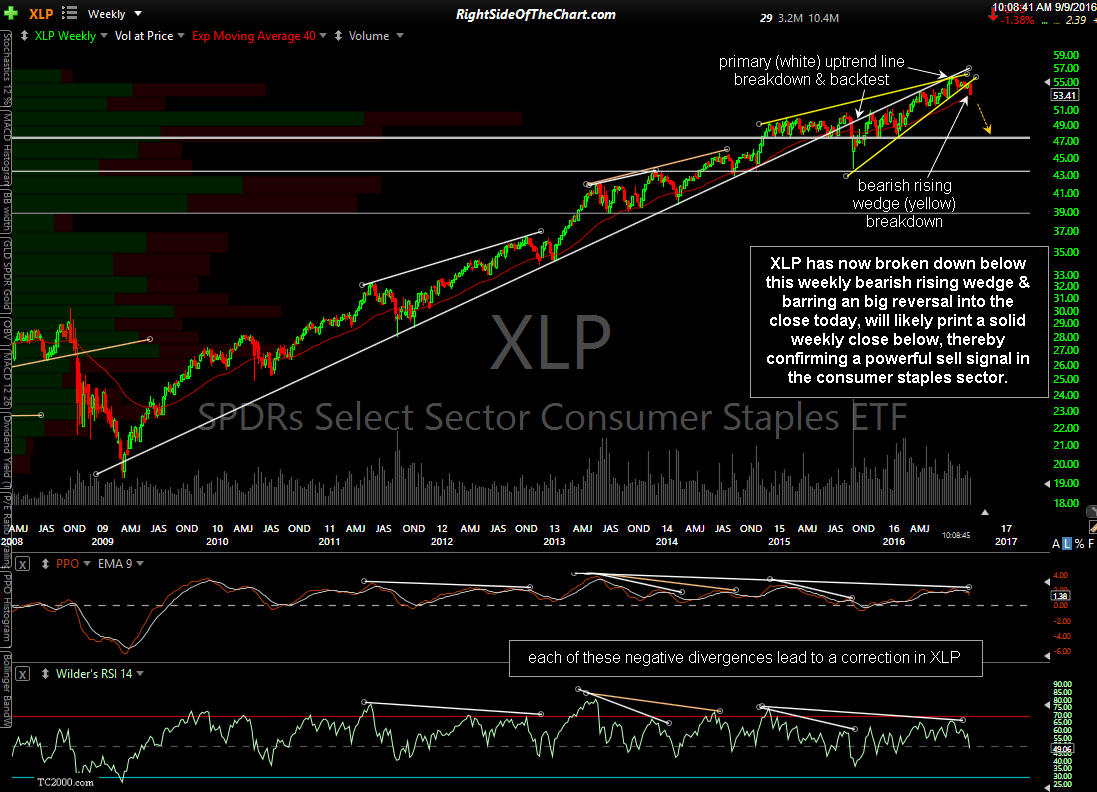

As a follow-up to the June 27th XLP & Consumer Staples Sector Outlook video, XLP has now triggered a solid sell signal on a solid breakdown below the bearish rising wedge pattern that was highlighted on the weekly chart in that video. Barring a big reversal into the close today, XLP will likely print a solid week close below that wedge pattern. This week’s wedge breakdown also follows the recent breakdown & backtest of the very well-defined primary bull market uptrend line off generated off the early 2009 lows.

It is quite unusual to see the Consumer Staples stocks poised for a significant correct or bear market at a point when we are 7½ years into one of the longest bull markets in history & more so, at a point in the business cycle where the economic indicators have been trending lower, indicating that the U.S. economy may be transitioning from an economic expansion to a contraction. Historically, consumer staples have been a relative safe-haven leading up to & following stock market & economic cycle tops, as the earnings of these “steady-eddie” companies such as Proctor & Gamble, Coca-Cola, Philip Morris, Colgate-Palmolive, etc.. are not nearly impacted as much during economic contractions/recessions as growth stocks such as technology companies.

Then again, this isn’t the typical bull market. In fact, the bull market over the past 7½ year is unlike any that we’ve every seen at any point in history. Unlike most bull markets, which are fueled by a robust expansion in the economy, the current expansion has been the weakest on record since WWII. Rather than a marked improvement in business conditions & increasing profits from organic growth, this bull market has been fueled largely from share buybacks (greatly facilitated by a ZIRP & the ability for corporations to borrow money very cheaply in order to finance those share buybacks) as well as a the fact that traditional income investors, that normally would have invested in bonds & CDs, have been left with no alternatives but to move into the stock market to purchase dividend stocks.

With the consumer staples stocks as being one of the most consistent sectors for both earnings & dividends, that is where a lot of these “safe money” income investors have piled in over the last 7+ year. In doing so, many of the stocks in the consumer staples sectors have reached nose-bleed valuations levels, many at levels never seen before. Therefore, the consumer staples sector may be at risk for a “rush for the exits” scenario, once the valuation bubble finally pops with the catalyst likely to occur once interest rates start to rise and the yields on safe money investments start to become more appealing.

XLP might be added as an official short trade idea soon although personally, I’d rather short the individual stocks with the most bearish technicals, such as the MO active short trade (which has just broken below the S1 support level today on the daily chart (notes/charts on the MO trade here).