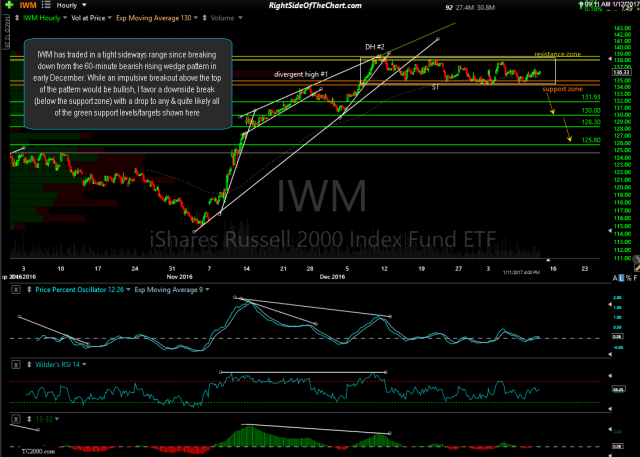

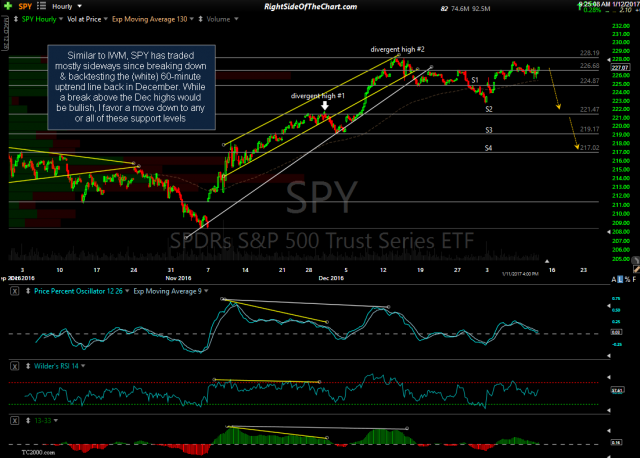

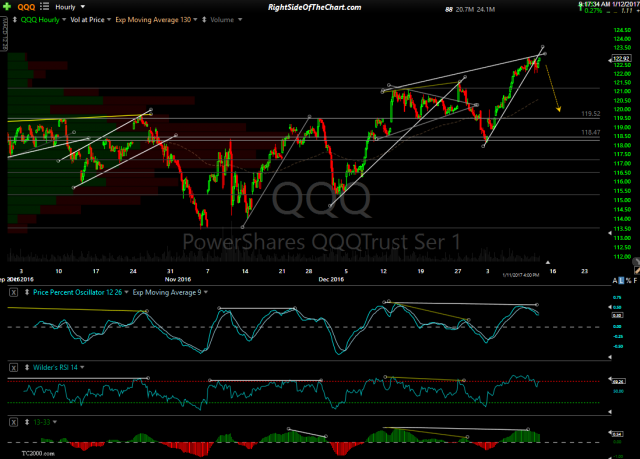

60-minute charts: IWM has traded in a tight sideways range since breaking down from the 60-minute bearish rising wedge pattern in early December. While an impulsive breakout above the top of the pattern would be bullish, I favor a downside break (below the support zone) with a drop to any & quite likely all of the green support levels/targets shown here. Similar to IWM, SPY has traded mostly sideways since breaking down & back-testing the (white) 60-minute uptrend line back in December. While a break above the Dec highs would be bullish, I favor a move down to any or all of these support levels. QQQ also looks poised to fall to at least the 119.50ish level in the coming days/weeks although I still can’t rule out my recent scenario that these major index tracking ETFs move up to make a slight marginal new & another divergent high before a meaningful reversal. (all of the charts above were screen-shoted before the open & reflect Wednesday’s close)

- IWM 60-min Jan 11th close

- SPY 60-minu Jan 11th close

- QQQ 60-minute Jan 11th close

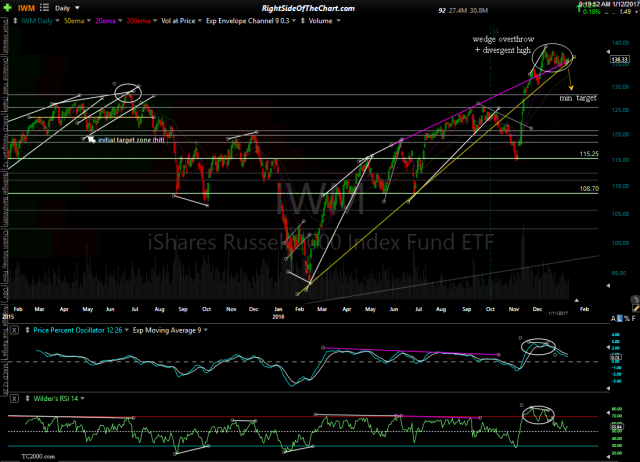

Daily charts: While the 60-minute charts can help give us an early indication of where prices might be heading in the near-term (other than when prices are chopping around in a sideways range as they’ve been lately), the daily charts carry a much higher weighting in my analysis of where the stock market is headed in the coming weeks & months+. Since the post-election rally, stock prices has appeared to stall out but the divergences that were in place before the Trump-Pump have only grown larger in scope with the bearish technical patterns still very much intact. As such, I continue to believe that the risk/reward is still skew to the downside at this time & in fact, I could very well see the possibility of a very sharp sell-off begin to commence in the coming days to weeks.

- IWM daily Jan 11th close

- SPY daily Jan 11th close

- QQQ daily Jan 11th close

While the front page posts & updates have been very light lately, largely due to the fact that there just haven’t been any new technical developments in the broad market to point out with the major indices trading sideways for weeks now, I have been fairly actively posting unofficial trade ideas within the trading room, both longs & shorts, some of which I may soon post as official & even unofficial trade ideas on the front page soon for the Silver members as well as the Gold member that have not have the time to catch up in the trading room.

Personally, I’m still keeping trading relatively light since before the holidays but I’m not letting my guard down with the recent muted price action in the broad market as I suspect a sharp move is on the horizon. As such, I’m going to spend today going through my watch-list & update the charts with notes & price targets on some of the more promising trade setups at this time.