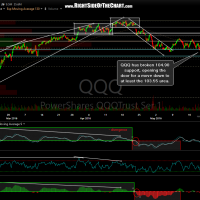

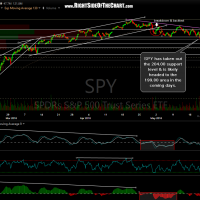

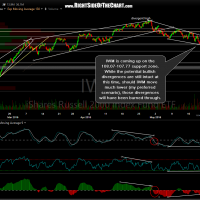

QQQ has broken 104.90 support, opening the door for a move down to at least the 103.55 area while SPY has taken out the 204.00 support level & is likely headed to the 199.80 area in the coming days. IWM is coming up on the 108.07-107.77 support zone. While the potential bullish divergences are still intact at this time, should IWM move much lower (my preferred scenario), those divergences will have been burned through.

- QQQ 60-minute May 19th

- SPY 60-minute May 19th

- IWM 60-minute May 19th

note: I’m going to run out for bit & will be back to answer any questions or trade update requests at least an hour before the close today. Barring some massive reversal & huge push higher, I can’t possibly see anything in the charts that would change my near-term bearish outlook and as I remain in swing trade mode at this time, I am not concerned with any of the intraday rips & dips such as we’ve seen lately. The near-term trend in the U.S. equity markets remains bearish & should the markets continue lower & close much below the aforementioned support levels that were recently taken out today, that would only act to solidify the intermediate-term bearish case, increasing the likelihood of a continued broad-based selloff in the coming days & possibly weeks+.

With Option Expiration (OpEx) tomorrow, they might try to hold the market up through the remainder of the week as that has been the typical pattern for some time now. However, patterns & trends don’t last forever & even the most consistent patterns in the market are marked with the occasional disconnect & those disconnects from the norm, when they do occur, are often marked with a powerful move in the opposite direction as the majority is caught off-guard while positioned on the wrong side of the trade. Personally, I’m sitting tight with my shorts for the time being. Back soon. -RP