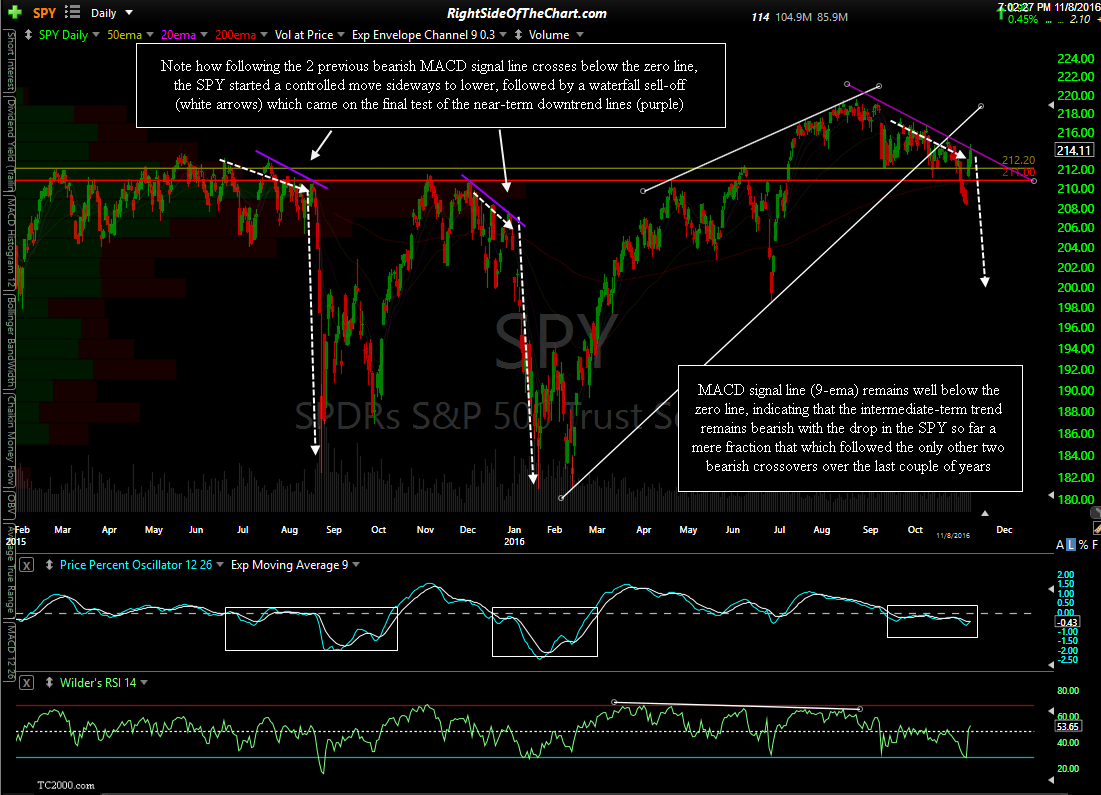

SPY (S&P 500 tracking ETF) closed right on the near-term downtrend line off that is generated off the Sept 7th highs. Note how following the 2 previous bearish MACD signal line crosses below the zero line, the SPY started a fairly controlled move sideways to lower, followed by a waterfall sell-off (white arrows) which came on the final test of the near-term (purple) downtrend lines. The MACD signal line (9-ema) remains well below the zero line, indicating that the intermediate-term trend remains bearish with the drop in the SPY so far a mere fraction that which followed the only other two bearish crossovers over the last couple of years. In other words, I still think that the odds for a very powerful & impulsive move down in the US equity markets are substantially elevated at this time.

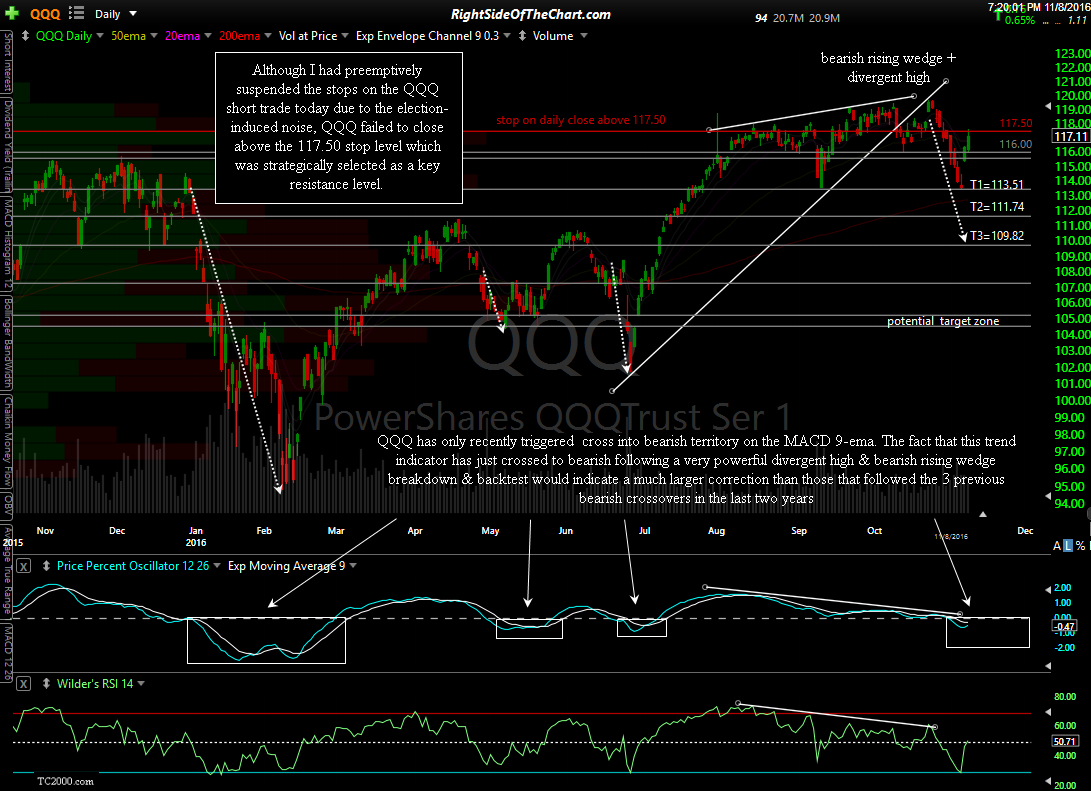

QQQ (Nasdaq 100 Tracking ETF) has only recently triggered a cross into bearish territory on the MACD 9-ema. The fact that this trend indicator has just crossed to bearish following a very powerful divergent high & bearish rising wedge breakdown & backtest would indicate a much larger correction than those that followed the 3 previous bearish crossovers in the last two years. Although I had preemptively suspended the stops on the QQQ short trade today due to the election-induced noise, QQQ failed to close above the 117.50 stop level which was strategically selected as a key resistance level.

On a final note, I’m doing my best to catch up on questions & chart requests with the trading room & comment sections although I’m a bit behind. I’ve have a cold or possibly the flu this week which had ramped up quite a bit today. I’ll be at doctor’s appt tomorrow morning, returning around 10ish ET & will continue to catch up on any unanswered questions, market updates or trade ideas from there.