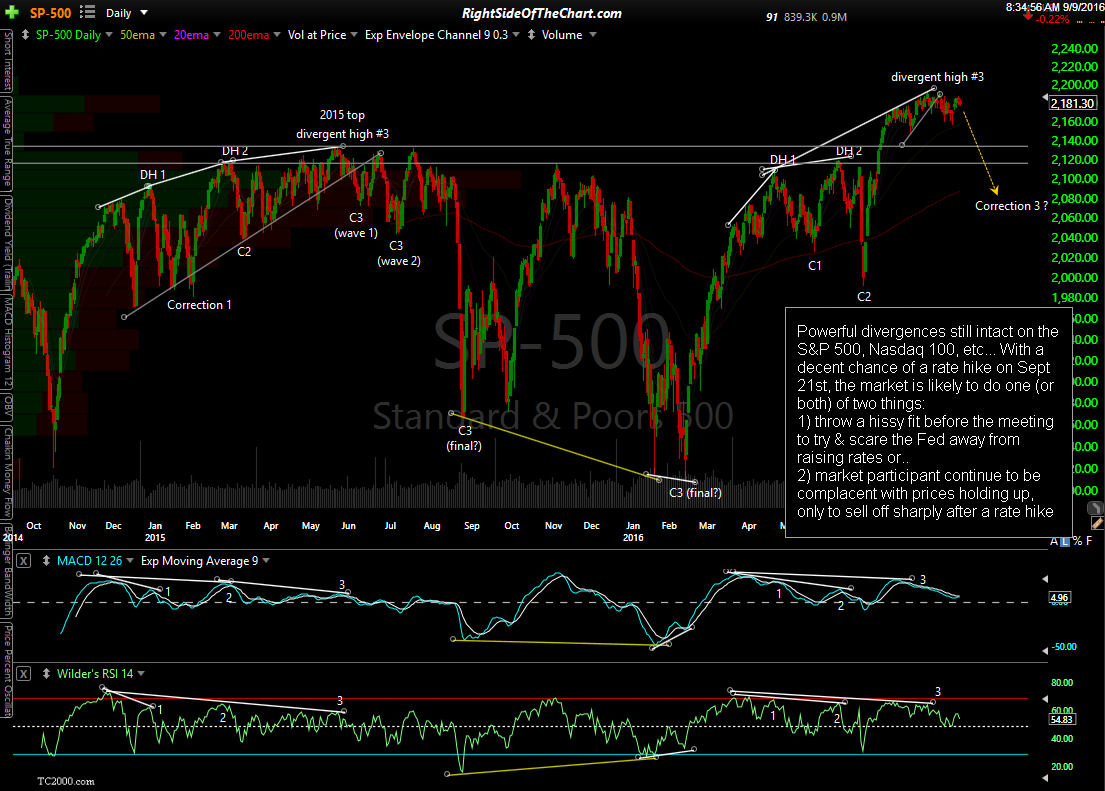

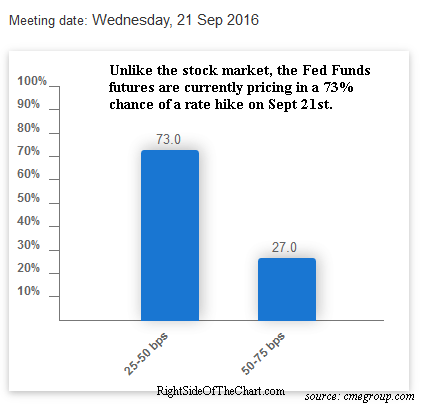

Powerful divergences still intact on the S&P 500, Nasdaq 100, etc… With a decent chance of a rate hike on Sept 21st, the market is likely to do one (or both) of two things:

1) throw a hissy fit before the meeting to try & scare the Fed away from raising rates, at it has done on all previous occasions when a decent chance for a rate hike was on the table or..

2) market participants remain complacent, with prices holding up near all-time highs, only to sell off sharply after a rate hike, should we get one at the conclusion of the Sept 20-21st FOMC meeting.

- 5-year treasury yield

- Rate hike probability -sept 9th

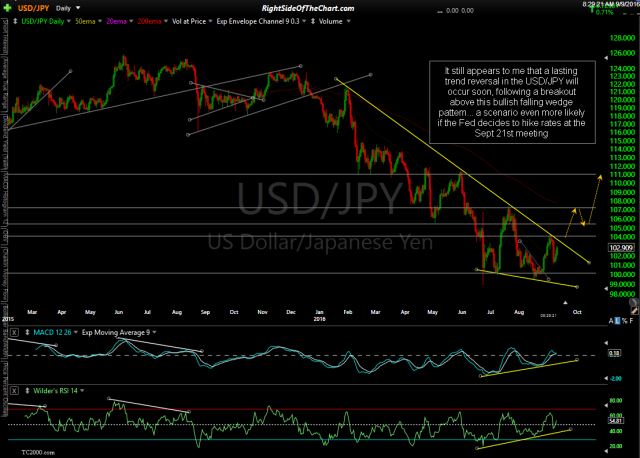

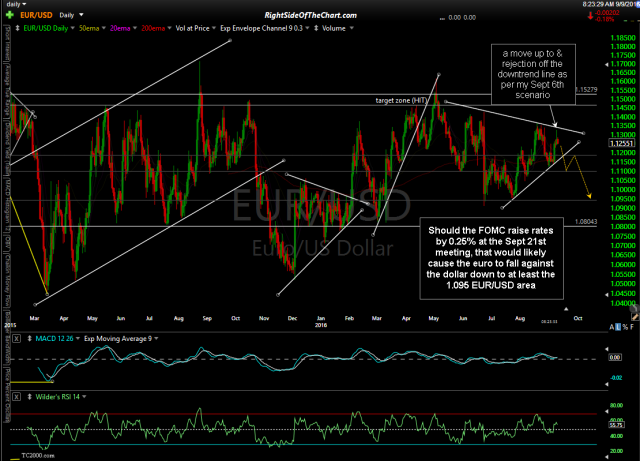

Should the Fed raise rates later this month, the effects wouldn’t be limited to just stocks & bonds but would likely have a direct impact on global currencies, with the dollar rallying against the Euro & the Yen, with the technicals on both of those two largest components of the US Dollar Index already reflecting the likelihood of a likely rally in the US Dollar, especially against the Japanese Yen. Should these scenarios play out, a rising dollar is also likely to have at least near-term bearish implications for gold & the gold mining sector as discussed in this recent post.

- USD/JPY daily Sept 9th

- EUR/USD daily Sept 9th

Bottom line is that we’ve seen a lot of chatter about the likelihood of a Fed rate hike in recent years, yet each time it appeared like a hike might really be on the table, the stock market threw a hissy fit like a bunch of spoiled children that didn’t want to stop drinking from the delicious punch bowl, with good ol’ mama Yellen giving in to their tantrums & giving the spoiled brats more of the sweet, sugary drink that they just can’t get enough of.

Maybe we get a rate hike on Sept 21st, maybe not. However, it appears to me that the R/R over the next two weeks is clearly skewed to the downside as either the market repeats its usual pattern of selling off in front of any FOMC meeting where there is any decent chance of a rate hike or the market remains complacent, as it has recently, and traders & investors run the risk of holding stocks at nose-bleed valuation levels at what could prove to be the beginning of the first rate hike cycle in years.