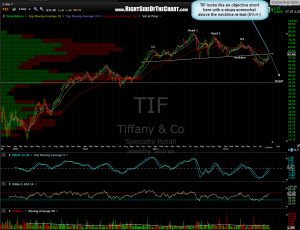

this one’s about as straight-forward as it gets: TIF recently broke-down from a clean double-headed H&S pattern, prices got sucked up in the volume-less rally and have pushed back up to re-test the neckline from below. TIF offers an objective short here with a stop not too far above the neckline. 5-10% above is probably idea based on the distance to target and of course, depending on your own risk tolerance and trading style. remember, trading is all about selecting only trades offering a favorable risk to reward (R/R) ratio. a 10% stop equates to about a 6 point loss on this trade while the target is around 39.70, or roughly 21 pts lower, for an R/R of 3.5:1 or 7:1 if using a 5% stop.

this one’s about as straight-forward as it gets: TIF recently broke-down from a clean double-headed H&S pattern, prices got sucked up in the volume-less rally and have pushed back up to re-test the neckline from below. TIF offers an objective short here with a stop not too far above the neckline. 5-10% above is probably idea based on the distance to target and of course, depending on your own risk tolerance and trading style. remember, trading is all about selecting only trades offering a favorable risk to reward (R/R) ratio. a 10% stop equates to about a 6 point loss on this trade while the target is around 39.70, or roughly 21 pts lower, for an R/R of 3.5:1 or 7:1 if using a 5% stop.

edit: there’s also a nice gap around 63, a stop just above that area would also make sense from a technical perspective (i placed mine at 63.43).