As we have seen some very significant technical developments lately in addition to a substantial increase in new trade ideas, I just wanted to summarize my current positioning & thoughts on the market. My positioning & outlook for the market has been pretty consistent since the beginning of the year: The risk/reward for equities in general has been unfavorable while gold, silver, mining stocks & select commodities have offered some of the most attractive R/R‘s. With the U.S. markets essentially flat for the year ($DJIA & $RUT slightly negative and the $COMPQ & $SPX slightly positive YTD) and my expectation for considerable downside in the broad markets before year end, this has most certainly been a stock pickers (i.e.- traders) market and most likely will continue to be in the foreseeable future.

Even the precious metals & mining sector, which has comprised the bulk of my trade ideas this year, has been much more conducive to market timing (swing trading) than a buy & hold strategy. For example, in the gold mining sector we have experienced two strong rallies, one strong correction (retracing nearly 80% of the late Dec to mid-March rally) and the recent sideways market trading range in where prices have gone essentially nowhere for nearly 7 weeks now, in which I was able to side-step, just adding back exposure this week shortly before the breakout in gold. Equity trades, both long & short, on balance have been successful and have also benefited from a very selective market timing process. Since the start of the third quarter of 2011, barring a few relatively minor corrections, this market has been unusually conducive to buy & hold investing and BTFD (buy-the-*$%#@-dip) has most certainly been the mantra during this time.

While anything is possible in trading, my read on the charts indicates that buying the dips going forward, including this one, might not work out so well. As such, my current strategy is to sell or short the rips (back to resistance) and cover the dips (down to support) while continuing to be very selective in the sectors and individual stocks that I trade long or short… i.e.- trading the most attractive stocks, not the market (SPY, QQQ, etc…). As is often the case, my preference is to trade a long/short portfolio, consisting of the most attractive stocks and sectors, both bullish and bearish. Doing so provides the benefits of both diversification (amongst various sectors & industries) as well as hedging (holding both long & short positions), should my read on the overall direction of the market or particular sectors prove wrong.

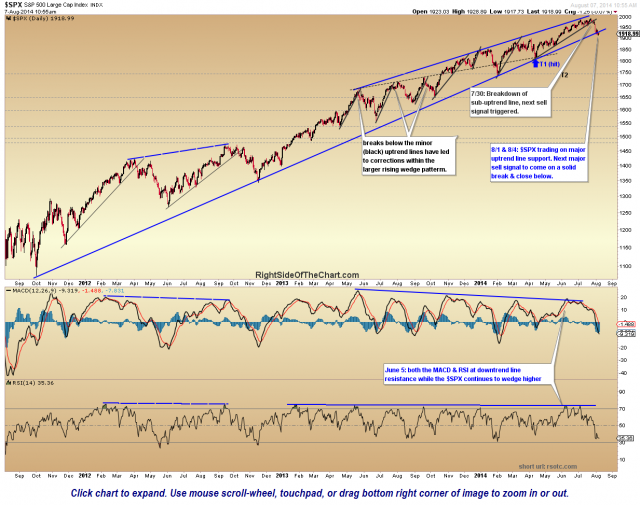

With that being said, I have several new trade ideas, both long & short, to share and I also plan to remove some of the “dead money” Active Trades in order to streamline the trade ideas and focus on the most promising trades at this time. The broad market became quite oversold on the near-term time frame as the $SPX hit the primary uptrend line on the daily chart (above) and has been clinging to that key support level like an exhausted swimmer to a life preserver since it first fell to that level last Friday. Note how all previous tags of that trendline in the past resulted in nearly immediately and powerful reversals, i.e.- shorts covered & the dip buyers aggressively stepped in. So far for nearly a week now that has not been the case, a potential sign that the supply-demand dynamics of this market have finally shifted. Of course, with prices still hovering around that key support level, it’s still too early to declare victory for either the bulls or bears. A very impulsive intraweek move below that level and/or a solid weekly close below would certainly bode well for the intermediate & possibly longer-term bearish picture while a solid move back above the trendline would indicate that there are still more willing buyers than sellers out there at this time.