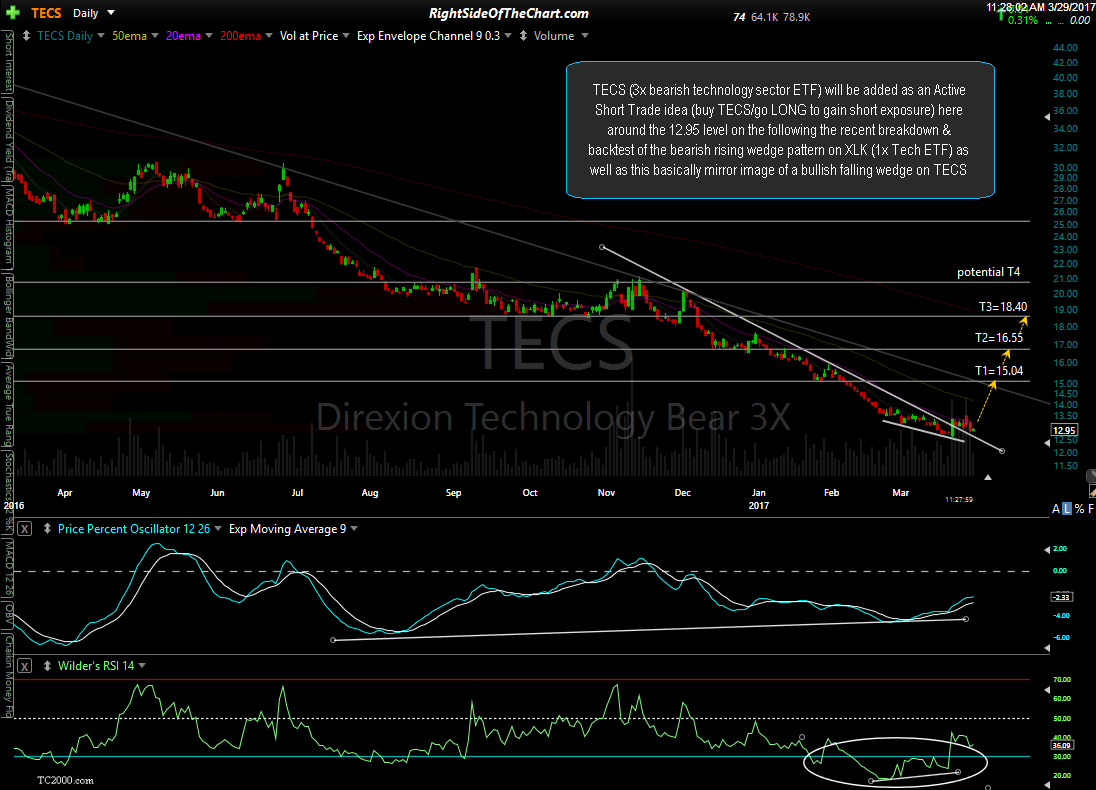

TECS (3x bearish technology sector ETF) will be added as an Active Short Trade idea (buy TECS/go long to gain short exposure) here around the 12.95 level on the following the recent breakdown & backtest of the bearish rising wedge pattern on XLK (1x Tech ETF… 2nd chart below) as well as this mirror image of a bullish falling wedge on TECS (below).

Typically, I refrain from swing trading leveraged ETFs on the long side as the decay suffered from the leverage can be quite detrimental at times (see the FAQ section for a detailed explanation under the FAQ; Is There A disadvantage to holding a leveraged ETF….). However, as explained in that FAQ, there are instances where the leveraged ETFs can actually outperform the underlying index by more than the amount of leverage used (e.g.- a return of well over 300% that of the underlying index when trading a 3x leveraged ETF). The periods where leveraged ETFs are likely to provide returns in excess of the underlying index multiplied by the amount of leverage employed by the ETF are fairly uni-direction trends, with minimal counter-trend reactions and/or extended periods of choppy consolidation.

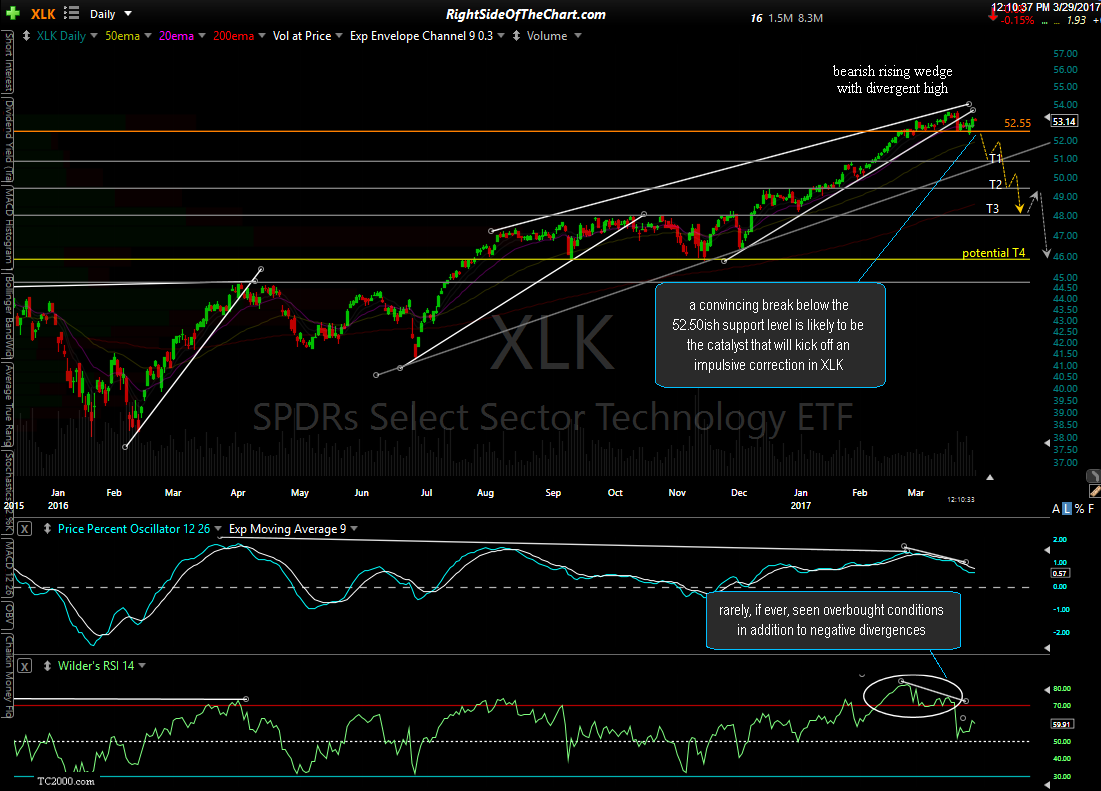

I’ve spent many hours analyzing the charts of the broad market & in particular, the technology sector (via the SPDRs Select Sector Technology ETF, XLK) as well as studying the charts of all 71 components of XLK on various time frames. In doing so, I have a high degree of confidence that not only are the majority of technology stocks likely to correct within the next few months+ but also likely to experience a fairly swift & steady downtrend in the process.

Should my analysis & expectation for a relatively large & impulsive correction in the tech sector prove to be the case then TECS is likely to post returns in excess of 3x the non-leveraged XLK. Case in point: Over the span of the most recent rally in the S&P Technology Sector Sector Index (which XLK, TECS & TECL all track, with the latter two employing 300% leverage short & long) from the lows on Dec 2, 2016 to the recent highs on March 21st, XLK posted a return of 15.44% while TECL (3x bullish Tech ETF) posted a return of 55.6%. That provided TECL with a return of 20% above 300% of the return in XLK over the same time period. That very substantial out-performance (above 3x the return of the underlying index/1x ETF) was due to the fact that that 3½ month rally was nearly unidirectional (i.e. straight up with very few red closes or periods of consolidation).

As my expectation is for a minimum drop of 4.35% in the tech sector from current levels & a “preferred scenario” of a 9.8% drop in XLK from current levels before any substantial reaction (which should correlate to a 44% gain for TECS if that target is hit following a fairly steady downtrend), I have decided to make the 3x leveraged TECS the preferred proxy for shorting the tech sector at this time. The current price targets (subject to revision as I may adjust those targets based on the charts of XLK going forward) are T1 at 15.04, T2 at 16.55, T3 (the current final target) at 18.40 with the potential for a fourth target possibly to be added around the 21 area, depending on how the charts of XLK & the broad market develop going forward. Comparable price targets/support levels where reactions are likely for those preferring to short XLK can be viewed on this daily chart below:

The suggested stop for this trade is any move below 11.40 which provides a fairly attractive R/R at that would account for a loss of about 12% if stopped out with a profit potential of about 44% if the current final target is hit. As always, consider a more aggressive stop if only targeting T1 or T2, ideally using a 3:1 or better R/R. The suggested beta-adjustment for this trade (having already taken into account the 300% leverage) is 0.4 at this time. Including the 3x leverage, that would provide a net short exposure comparable to just above a typical full position (0.4 x 3 = BAPS of 1.2) Personally, I plan to increase my position size above that if/when XLK makes a solid break and/or close below the 52.50 support level for a significant over-weighting short exposure to the tech sector, although I will also factor in the considerable overlap on my Nasdaq 100 & semiconductor shorts. As always, DYODD & trade according to your own risk tolerance, trading style & objectives and pass on any trades that don’t mesh with your own analysis or comfort level.

note: TECS will be listed under the Active Short Trades category as this is a short trade on the technology sector. However, one would buy or go long TECS to gain that short exposure as this is an inverse (bearish) ETF.