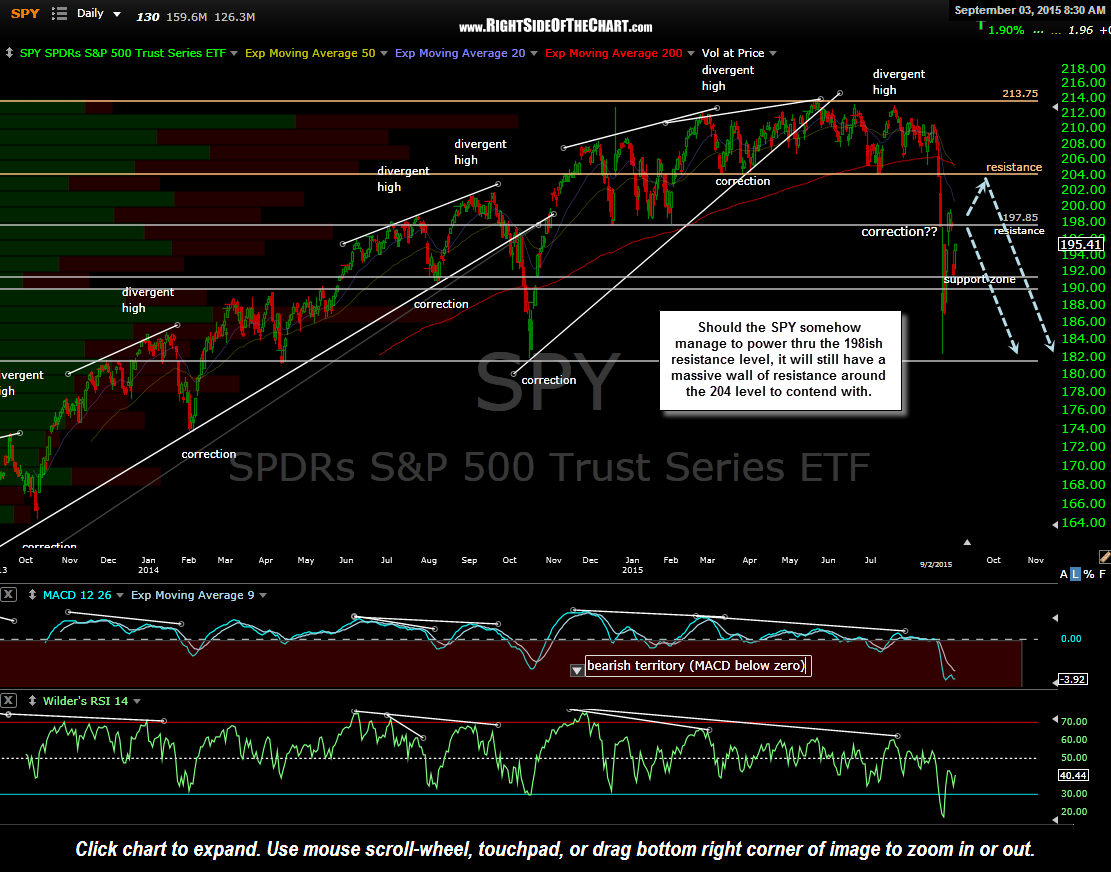

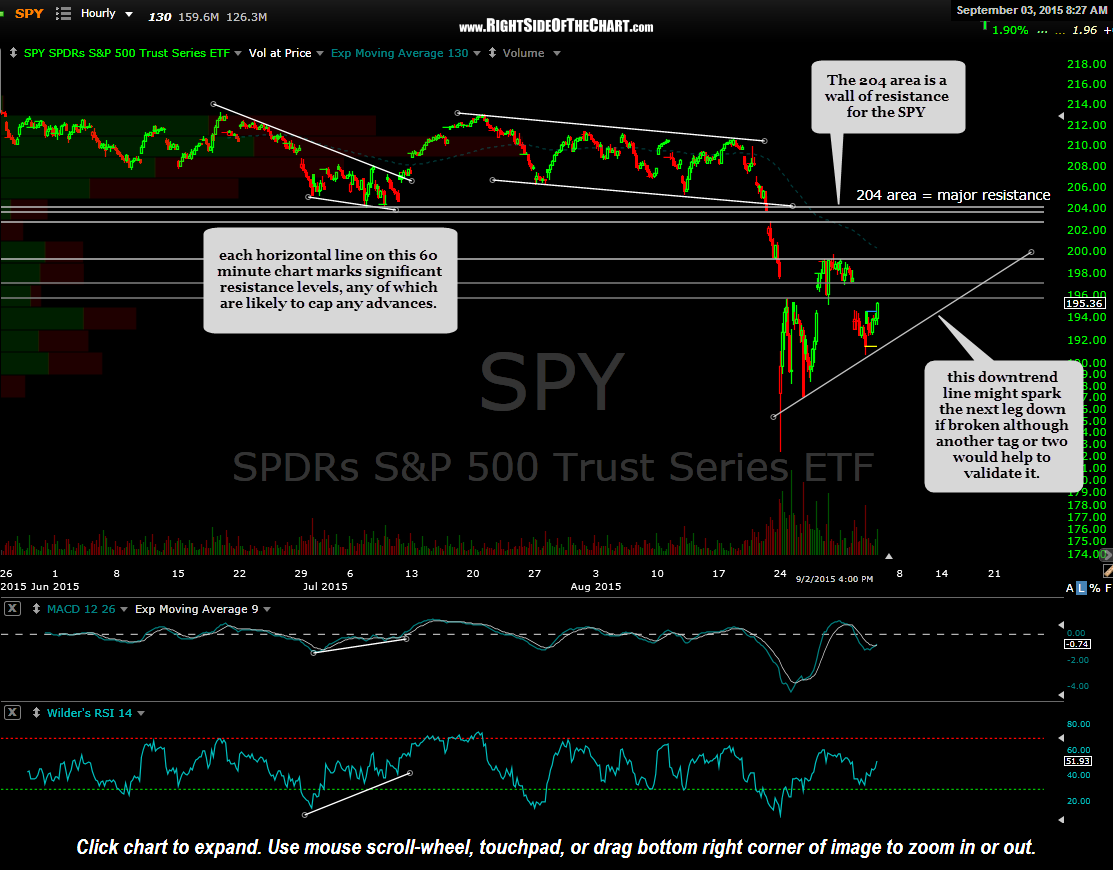

As seen on this daily chart, should the SPY somehow manage to power thru the 198ish resistance level, it will still have a massive wall of resistance around the 204 level to contend with.

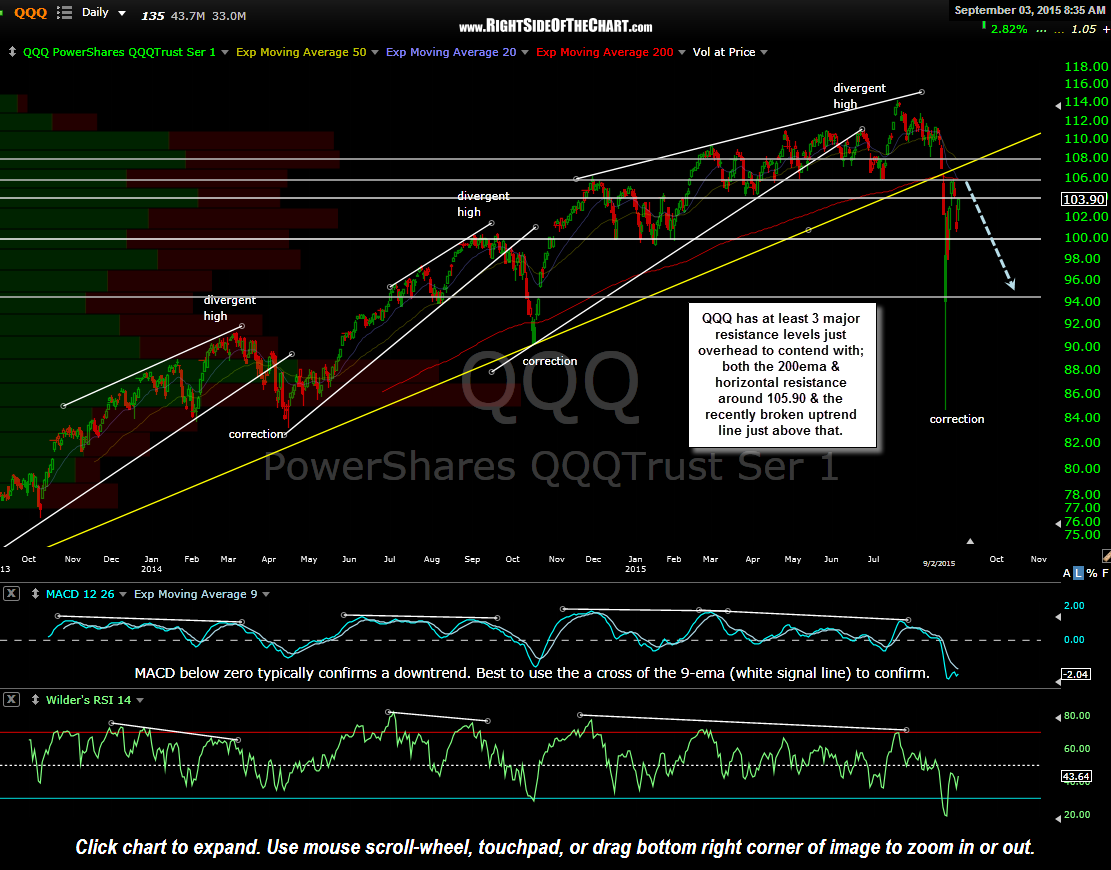

Looking at the daily chart of QQQ we have at least 3 major resistance levels just overhead to contend with; both the 200ema & horizontal resistance around 105.90 & the recently broken uptrend line just above that. Any move at or just below that area provides a very objective short entry or add-on with stops placed somewhat above the aforementioned resistance levels.

Bottom line: The near-term direction of the market is not very clear at this time although there are numerous well-defined short-term support & resistance levels that may provide day trading opps while swing traders can begin initiating or adding short exposure anywhere from today’s likely gap higher up until the major resistance areas shown on the daily charts above (with stops set somewhat above the top of those resistance zones).