The SPY/$SPX continues to consolidate above the T1 support zone and will likely move lower over the next few trading sessions. Any break below yesterday’s low (which was right around the 38.2% fib retracement level) should open the door for a quick move down to the T2 area or lower. However, as I like to say: Support is support until broken. Therefore, shorting or adding to short exposure around current levels would not be objective. Best to wait for a break below yesterday’s low IMO, which is less than 1% below current level. Those who are near-term+ bullish could certainly take a shot at adding long exposure on or slightly above the T1 level with stops just slightly below yesterday’s lows but again, the most bullish of my current scenarios (my alternative scenario) remains a possible move higher (which could last several days to a couple of weeks) to backtest the recently broken uptrend line on the $SPX daily chart with prices turning down from there. My preferred scenario remains a continuation of the short-term downtrend to resume shortly with the SPY heading towards the 175 area.

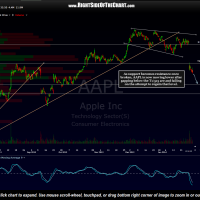

As previous highlighted, both AAPL & XOM recently failed on their attempt to regain the former support, which became resistance once broken. Since the backtest of their respective broken support, now resistance levels, both have turned lower as expected with XOM already hitting my next downside target immediately following the open today (and as expected, has bounced since). I will continue to monitor the charts of XOM & AAPL closely as they are the two largest components of the S&P 500 as well as the two largest companies in the world (as measured by market cap). As such, XOM & AAPL are likely to act like a ball & chain hitched to the broad market if they continue to underperform.

- SPY 2 hour Jan 30th

- AAPL 2 hour Jan 30th

- XOM 2 hour Jan 30th