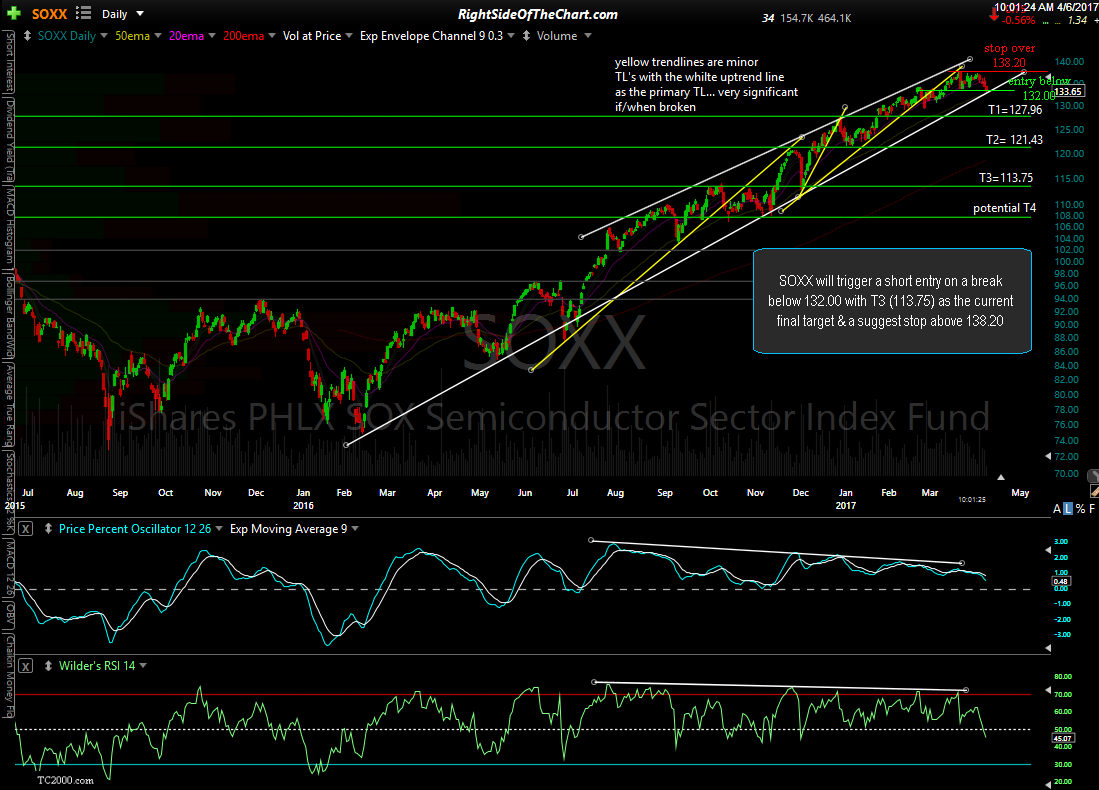

SOXX (iShares PHLX SOX Semiconductor Sector Index ETF) will trigger a short entry on a break below 132.00 with T3 (113.75) as the current final target & a suggest stop above 138.20. T3 (113.75 is the final price target at this time with a potential forth target around the 108 level that might be added, depending on how the charts of both the semiconductor sector as well as the broad markets develop going forward. The suggested beta-adjustment for this trade is 0.90.

I opted to used SOXX as the official proxy for shorting the semis as many traders prefer to use the inverse leveraged ETFs such as SOXS, which also allows for short exposure in non-margin accounts such as IRAs (which do not allow shorting). The resistance levels below on this SOXS daily chart roughly align with 3 of the 4 price targets for the SOXX short trade although these are the actual resistance level, unadjusted for an optimal fill (best to set your sell limit order slightly below and/or align them with the SOXX targets). Also note that although they track the same index, the charts don’t align perfectly due to the decay from the 300% leverage.

A couple of points to consider if shorting the semis:

- Make sure to take into account the fact that there is a lot of overlap with both the Nasdaq 100 (QQQ, SQQQ, etc..) as well as the Technology Sector (XLK & TECS). Therefore, one should take that overlap into consideration if shorting either the Q’s or the tech sector (both of which are Active Short Trades at this time).

- For those that prefer to use an SOXS (3x bearish semiconductor ETF) long or SOXL (3x bullish semiconductor ETF) short trade, make sure to account for the 300% leverage in your position size.

- My expectation is for a relatively swift move down to at least the 2nd price target in SOXX. Should that prove to be the case, the decay will be minimal, if any, on a long position in SOXS. However, should the semis grind around for an extended period of time, with a lot of back & forth, red & green closes, (assuming the stop isn’t hit first) then SOXS is likely to under-perform 300% of the drop in SOXX.

- Although SOXS will be listed as a Short Trade Setup (and an Active Short Trade, if the entry is triggered), one would buy (go long) SOXS to gain short exposure on the semis as shorting SOXS would provide a net long exposure to the sector.