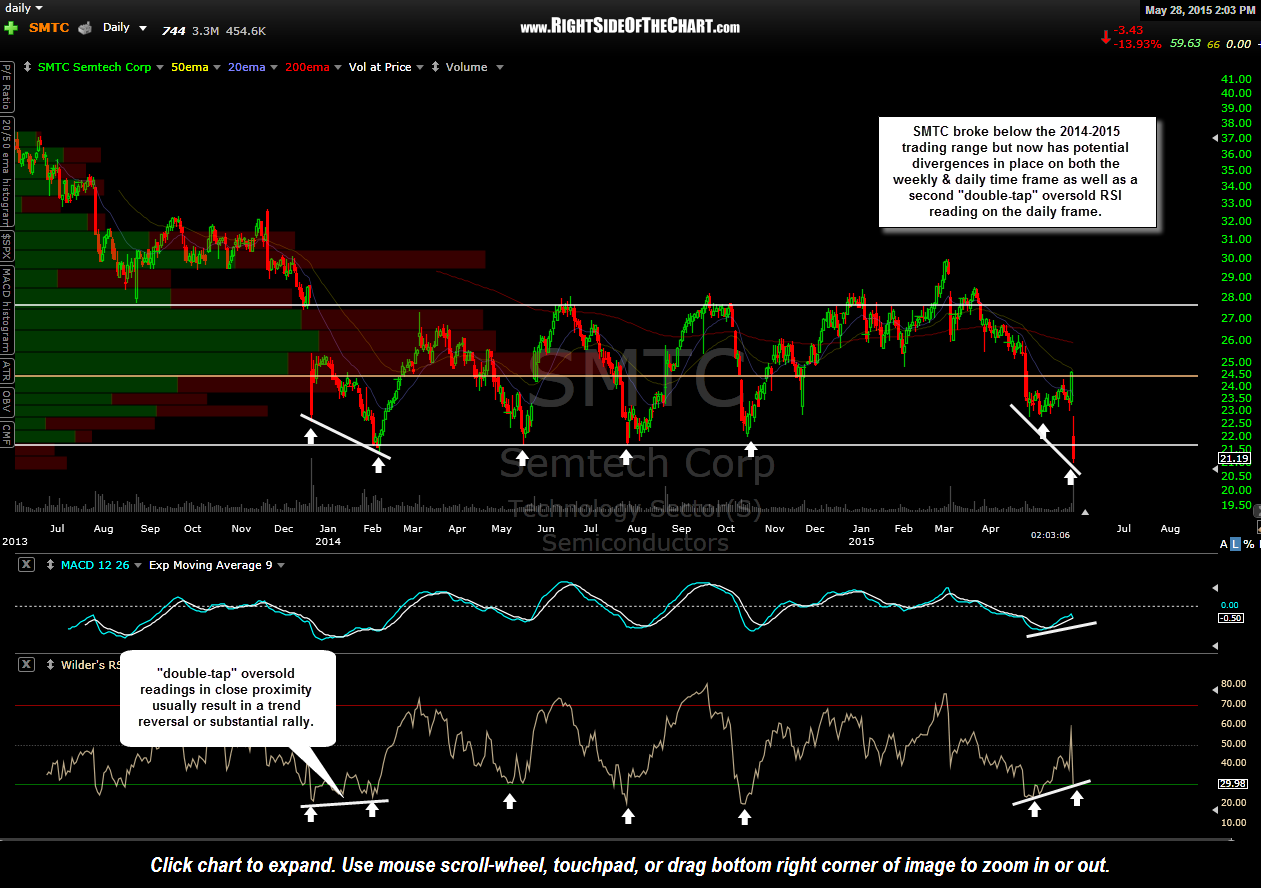

SMTC (Semtech Corp) did go on to punch thru the bottom of the aforementioned trading range as I had suspected it might. Although I’m still going to hold off adding SMTC as an official trade idea, I went ahead and decided to take a relatively minor position.

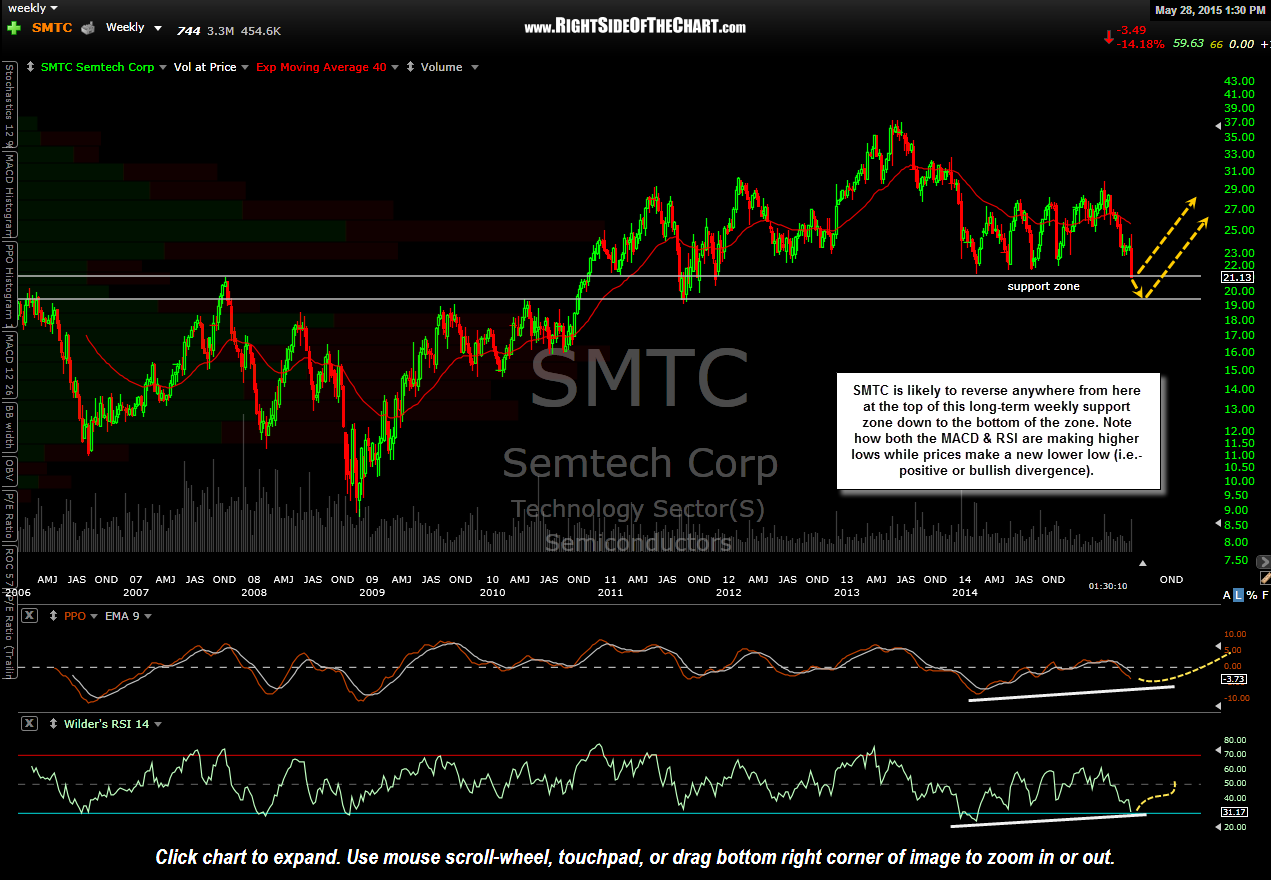

In my previous post, I had mentioned that a break below the trading range shown on the daily chart would set up bullish divergences on the stock but what I was not clear on was that I was mainly referring to the weekly chart although Semtech is also poised to print a divergent low on the daily chart as well, as long as prices don’t fall too much (thereby printing lower lows on the MACD and/or RSI).

Essentially, we now have what I like to refer to as potential positive divergences in place on both the daily & weekly time frames. To be more specific, I consider (positive) divergences as potential when the momentum indicator(s) or price oscillator(s) that I am watching are making a higher low while prices make a lower low but the indicator/oscillator is still heading lower (i.e.- a negative slope).

On the MACD, for example, I consider the divergence in place once/if the MACD makes a bullish crossover and starts heading higher (positive slope). With the RSI, I consider the divergence as in place if/when it turns back up after printing a higher low (vs. the price of the stock printing a lower low). Therefore, with both the MACD & RSI still moving lower, we only have potential bullish divergences in place at this time. However, being that SMTC is now at the top of a weekly long-term support zone, very oversold in the near-term and has potential bullish divergences forming, I view a long position here with a stop somewhat below the bottom of that weekly support zone (19.50) an objective long entry if targeting the upper end of the 2014-2015 trading range. One could also use a more aggressive stop of 20.00 or higher, only targeting the middle of the 2014-2015 trading range (24.50 area), which would provide an R/R of 3:1 or better.

I may decide to add to this position, should SMTC continue lower towards the bottom of the weekly support zone (19.50ish) or I may just take profits if the stock experiences a sharp snap-back rally in the coming days/weeks. However, SMTC will remain an unofficial trade idea at this time although I will likely post updates on any significant technical developments.