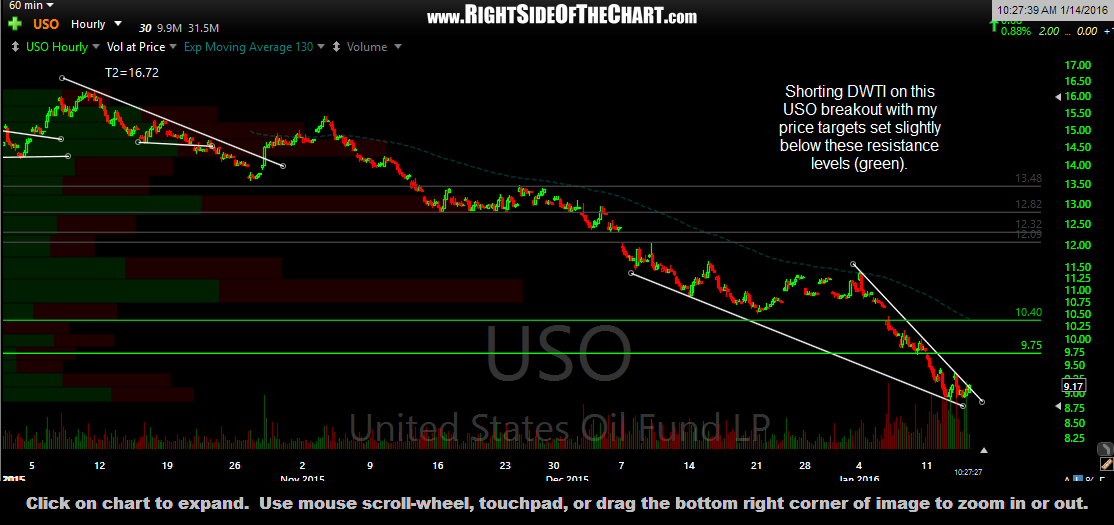

Shorting DWTI (3x bearish/short crude oil ETP) on this USO breakout with my price targets set slightly below these resistance levels (green). CL (crude futures) also broke out above the downtrend line on the 60-minute chart posted in the trading room after the close yesterday, helping to confirm the entry. Exact price targets & suggested stops to follow asap… it’s been a busy morning reversing numerous positions long to short. More charts & commentary as soon as things slow down.

For those unable to short DWTI, a short of USO or a UWTI long is a viable option unless you plan to hold the latter for more than a week or so . My expectation is for a relatively swift & uni-direction move up to the 9.75 level in USO. If (and a big IF) that happens, the decay on UWTI will be minimal, if any. Again, that assumes a strong rally with very few, if any, down days in crude before that target is hit.