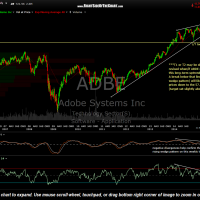

ADBE (Adobe Systems Inc) will be added as an Active Short Trade here following the recent breakdown & backtest of the bearish rising wedge pattern shown on this daily chart. Being that that primary trend remains bullish at this time, my preferred price target is T1 (69.85) although T3 is the current final target and will likely become my preferred swing target should the US equity markets begin to roll over soon as expected.

- ABDE daily 2 April 16th

- ADBE weekly April 17th

The suggested stop for this trade is any move over 77.09, which is slightly above the recent highs/backtest of the wedge pattern. I’ve listed T2 as a target zone at this time with the exact suggest buy-to-cover level to follow. However, keep in mind that T2 and possibly T1 may be revised as this trade is also based off the bearish technical posture of ABDE on the weekly time frame. As with the daily chart, ABDE has also formed a bearish rising wedge pattern on the weekly time frame, albeit a much larger pattern that would indicate a much deeper move lower on Adobe, should prices break below that larger wedge.

As is usually the case, my expectation would be for a reaction on the initial tag of the bottom of that weekly rising wedge. If this trade plays out as I would expect based off of the daily chart, that would bring prices to the bottom of the weekly wedge around the same time that they approach T1 or T2 on the daily time frame, hence my flexibility on these targets as I would expect a reaction when the first of these targets/support levels are hit.

Based on the entry price of 75.37 posted on Twitter and the suggest stop of 77.10, ADBE offers an extreme attractive R/R (risk-to-reward ratio) of over 10:1 (i.e.- $1 of loss risked for $10 of profit potential). Should I decide to book full profits and remove the trade at T1, assuming that level is hit, ABDE would still offer a fairly attractive R/R of about 3.2:1.

note: The Twitter feed is occasionally used to send out immediate updates on timely trade ideas or market developments which may or may not be posted afterwards on the site. As it can take anywhere from 10 -30+ minutes to annotated a chart, upload the images & compose a post with detailed notes on the trade such as this, Twitter is simply a more efficient means to quickly send out time-sensitive market developments and trade ideas. It seems that some web-browsers will automatically refresh the Twitter feed located on the RSOTC homepage while others need to be refreshed. This is an issue we are looking into & hope to resolve where the feed will automatically update in all browsers.